- Home

- >

- Fundamental Analysis

- >

- Seasonal trends and patterns for September

Seasonal trends and patterns for September

What do seasonal patterns for September say and what can we expect from the markets during the month?

Overall, the month is not one of the best for tracking seasonal trends and patterns. This is not surprising. July and August were mostly vacation months. The return of market players, bankers and politicians in the coming weeks will revive market dynamics.

The same goes for stock managers. Summer has become a metaphor for boredom and boredom, but September is exactly the month when investors start thinking about the end of the year and positioning themselves for the next. In August, when the markets were in auto pilot, seasonal models performed very well.

Looking ahead, news about the Fed, ECB, BOC and tariffs will move the markets this month, which could threaten known behaviors for September. Here are some scenarios that could develop over the course of the month.

Crude Oil. Oil is definitely going through a pretty difficult year. September has generally been a neutral month for "black gold" in the last 10 years, but signs of continued depreciation in the last months of the year are intensifying. Hurricanes will be in focus this month. Yes, they usually push the price up when they hit, but currently the US produces so much oil that there is a risk of increasing stocks further if refineries close. September may not be the right month to sell oil, but definitely look for shorts on the tops. September, on the other hand, is one of the best months for natural gas, but this year, the resource has taken quite a hit.

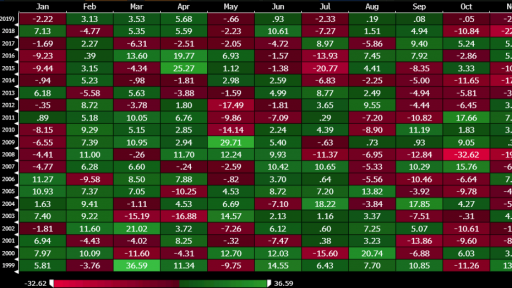

Stocks, and in particular Canada. September is usually pretty tough for global stock markets. Since 1990, this month is one of four in which the S & P500 typically ends in a slump.

One particular broad index is weak this month - Canada's main benchmark. The TSX Composite for the last 28 years ended with an average score of -1.28%. Along with weak oil during this period, the Canadian dollar is also experiencing difficulties in the last months of the year. On the other hand, the September - December period is very good for the Nikkei 225.

USD/CHF. September is the second strongest month for USD/CHF. Despite the expected seasonality, however, the Swiss franc is not rising at the expected pace. However, the likelihood of it remaining strong by the end of the year is low, given that speculators are short and the Swiss National Bank may intervene after the ECB meeting this month.

Gold. The second weakest month for precious metal. Over the last two months, the resource has enjoyed an extremely rally, but maybe it's time for consolidation?

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.