- Home

- >

- Opportunities for profit today

- >

- Top 3 Stocks With Plenty of Upside Ahead

Top 3 Stocks With Plenty of Upside Ahead

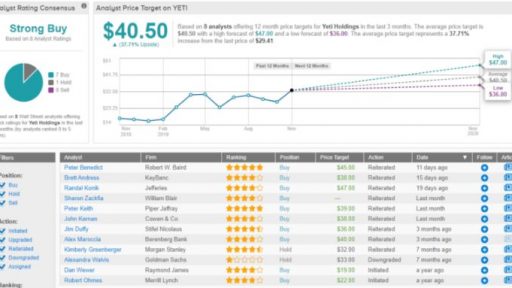

Yeti Holdings (YETI)

Unicorn brands are a rare sight; hence they’re called - you guessed it - unicorn brands. The title refers to a privately held company that reaches a value of $1 billion. One such brand making quite a splash since going public is Yeti Holdings.

The outdoor product manufacturer held its IPO in October 2018 and has mostly been on a cool upward trend ever since. It has made excellent progress in building its brand identity, seducing lovers of the outdoor lifestyle with its varied line of products. As a result, it now boasts 1.3 million followers on Instagram.

Following previous strong quarters, 3Q continued the trend. Sales came in at $229M beating the $222M estimate, alongside increasing sales growth. Yeti delivered on EPS too - at $0.30 it beat the Street’s estimate of $0.26.

Looking ahead, Jefferies’ 4-star analyst Randal Konik thinks the growth is set to continue, noting, “YETI is a brand that consumers (Pros/ Joes) love & also see as a gifting destination.” He adds, “We see significant opportunity for YETI to expand its TAM as it broadens its exposure to non-heritage markets in the US and international over the long-term. With continuous innovation in new and existing product categories, and a quickly growing margin-enhancing DTC channel, we believe top-line and margin opportunities are significant.”

CryoPort (CYRX)

With a motto of “Science. Logistics. Certainty.” CryoPort, which provides cold chain logistics solutions to the life sciences industry, presents itself boldly.

In layman’s terms, it is a frozen shipping container company moving biological specimens around the world in sub-zero temperatures. Its clients include biopharmaceutical, IVF and surrogacy as well as animal health organizations across the globe.

The company recently posted strong 3Q19 results, with revenue up 81% year-over-year, and positive adj. EBITDA for the second consecutive quarter. Among the highlights in the report were increased market share in the regenerative medicine clinical trial sector and a strategic partnership with Lonza. Lonza provides product development services to the pharmaceutical and biologic industries and is considered one of the largest players in the field.

Needham’s 4-star analyst Stephen Unger thinks the partnership is good news for CryoPort, noting, “The goal of the partnership is to provide customers developing cell and gene therapies with a fully integrated solution for outsourced manufacturing and cold-chain logistics, which we see increasing customer visibility of CYRX's best-in-class logistics solutions earlier in the therapy development process.” Following the quarterly report and positive developments, Unger maintained his Buy rating on CYRX. His price target is $24.00.

Sonos (SONO)

Speakers act louder than words, so the phrase goes. Well, not quite, but it does lead us nicely to our final choice.

Consumer electronics company Sonos is mostly known for its smart speakers. Apart from the excellent sound quality, Sonos’ Sonoset system creates a custom Wi-Fi network, eliminating the need for old fashioned wires and allowing for music to be played simultaneously in different rooms.

This is great for household systems, and earlier this year Sonos partnered with furniture giant Ikea on a new line of products, an alliance RBC Capital’s Robert Muller thinks has the potential to drive new customer adoption.

The analyst said, “We believe the true value of Sonos lies in the family ecosystem whereby additional speakers complement one another. Once exposed to Sonos, we expect new customers to quickly envision the benefits of additional speakers throughout their homes. If SONO is able to expand the number of homes it's in (currently in ~8MM worldwide with nearly 4MM in the US), we should see a wave of secondary purchases.”

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.