- Home

- >

- Daily Accents

- >

- 10-year Japanese government bond yield hits zero

10-year Japanese government bond yield hits zero

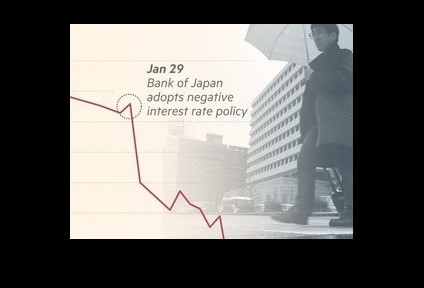

Japan stumbled into a new era on Tuesday when it became the first G7 country to hit a yield of zero on its benchmark 10-year government bond as stocks nosedived and the yen climbed to a 15-month high against the dollar.

But as demonstrated by the move in the yen — described by finance minister Taro Aso as “rough” — Japan and its Abenomics growth programme are buffeted by outside turmoil, particularly the slowdown in China and market ructions in Europe. Traders suspect the yield on the 10-year JGB could fall deeper into negative territory this month. A negative yield on a bond - which means investors are effectively paying for the privilege of lending Japan's government money - suggests continued strong demand for JGBs.

But as demonstrated by the move in the yen — described by finance minister Taro Aso as “rough” — Japan and its Abenomics growth programme are buffeted by outside turmoil, particularly the slowdown in China and market ructions in Europe. Traders suspect the yield on the 10-year JGB could fall deeper into negative territory this month. A negative yield on a bond - which means investors are effectively paying for the privilege of lending Japan's government money - suggests continued strong demand for JGBs.

The appreciating yen is equally uncomfortable for the government. A weak currency is one of the major hallmarks of Abenomics and its ultra-loose monetary policy, and has in turn propelled corporate earnings and the stock market higher.

Investors' attention will now focus on expected tomorrow statement of Janet Yellen. If it is a signal that the Fed takes a hard position of passively waiting, USD will likely continue to decline against the JPY. Currently estimates that there will be a new increase in US interest rates in March-April fluctuate between 2% and 4%.

Investors' attention will now focus on expected tomorrow statement of Janet Yellen. If it is a signal that the Fed takes a hard position of passively waiting, USD will likely continue to decline against the JPY. Currently estimates that there will be a new increase in US interest rates in March-April fluctuate between 2% and 4%.

(source: FT)

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.