- Home

- >

- FX Daily Forecasts

- >

- Critical support for the USD, would it hold?

Critical support for the USD, would it hold?

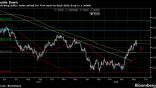

The dollar index is nearing an inflexion point. A set of key technical levels that has underpinned the greenback is within striking distance, which if breached could signal prolonged weakness as per Sejul Gokal.

The bullish turn of Treasuries and positioning in the currency options market could hasten the downfall of the gauge, which tracks the greenback against the euro, yen, pound, Canadian dollar, Swiss franc and the Swedish krona.

The DXY has dipped below the year-to-date low of 99.23 set before President Donald Trump failed to push through his health-care reform. If this move holds on a daily and weekly closing basis, that could spell trouble for the dollar bulls.

Still, dollar bears have to contend with a confluence of barriers that continue to support the U.S. currency.

While the DXY has dropped below the 38.2% of Fib retracement line of the rally from May to January, the 200-day moving average and the May 2016 bull trendline could act as the next line of defense. Before that, an important level to watch would be $98.92, the 61.8% Fibo retracement of the rally since Trump's electoral win.

A closing break back above 100 would neutralize the near-term downside risks.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.