- Home

- >

- Stocks Daily Forecasts

- >

- Which kind of stocks is the best for the 2nd half of 2017

Which kind of stocks is the best for the 2nd half of 2017

So far this year, indexes tracking growth stocks have performed much better than those tracking value stocks. But that trend appears to have shifted in the past month, and some strategists think it's wise to play for a big value comeback.

Growth indexes — which track the subset of companies that have seen sharp growth in sales and earnings — are largely composed of tech stocks, whose shares have risen considerably over the past year.

Value indexes — which track stocks with low prices relative to their earnings, sales and book values — now have outsized holdings of financial and energy stocks.

The recent tumble in big tech stocks amid a generally stable market has been a boon for the relative performance of values stocks.

"At mid-year we are starting to see signs that investors are diversifying back into value stocks since growth performance started to wane in June," S&P Global portfolio manager Erin Gibbs.

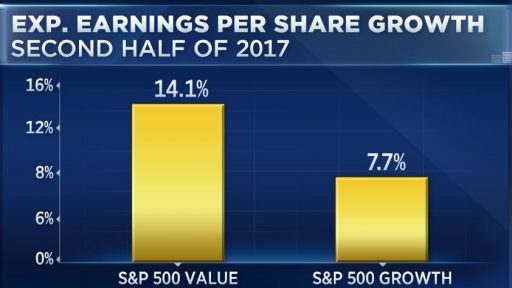

She also points to a striking fact that turns the whole growth-versus-value debate on its head: The S&P 500 growth index is expected to see overall earnings per share growth of 7.7 percent in the second half of the year, while the S&P 500 value index is expected to see earnings growth of 14.1 percent.

All in all, value stocks are "well-positioned for the balance of 2017," Gibbs concluded.

Source: Bloomberg

Junior Trader Stefan Panteleev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.