- Home

- >

- Commodities Daily Forecasts

- >

- Is oil ready to rebound?

Is oil ready to rebound?

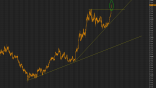

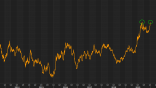

Oil prices had a rather abrupt reversal last week, raising concerns that the declining channel was beginning to break down to some extent. However, this seems to be at odds with the broader technical bias which suggests that a rally back up to the 48.55 mark is still plausible. Indeed, oil is already showing early signs of a recovery – potentially a rather sizable one.

Nevertheless, on the face of things, oil’s bias does look rather bearish and fears of continued losses may not be altogether unwarranted. What’s more, in the long run, further losses are almost certain as we aren’t expecting the commodity to overcome the fundamental forces causing its long-term decline any time soon. However, the most recent push lower could very well be fleeting and a proper testing of the upside constraint of the channel is still a real possibility.

One of the key technical readings suggesting that recent losses are about to reverse is the MACD oscillator which, despite a nearly 6% fall in oil prices, continues to signal that bullish momentum is intact. When combined with the presence of some long shadows on the two prior candles, a reversal around the 44.30 handle is looking rather likely. Moreover, a reversal here would confirm the presence of a corrective ABC wave – a sign that the uptrend could resume very shortly.

If buying pressure does return, it should see oil back up to the top of the channel but no higher than the 48.55 handle. Indeed, any price action above the $47 mark is going to be up against some strong headwinds given the presence of the 100 day moving average and the prevailing pessimism over the future of oil prices. As a result of this, we should see yet another extended downtrend take hold eventually and this may reach as low as the $40 handle.

Ultimately, we may have to wait for the US Crude Oil Inventories data to be posted before oil prices really get moving again. Currently, a draw is expected, which could be the spark needed to put the bulls back in the driving seat. Nevertheless, keep an eye on the release as an unexpected build could dash any hopes of a near-term rally and see oil plunge back to form a double bottom structure.

Source: Bloomberg Pro Terminal

Junior Trader Stefan Panteleev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.