- Home

- >

- Daily Accents

- >

- LME’s Silver Contract Languishes in Second Place as Gold Shines

LME’s Silver Contract Languishes in Second Place as Gold Shines

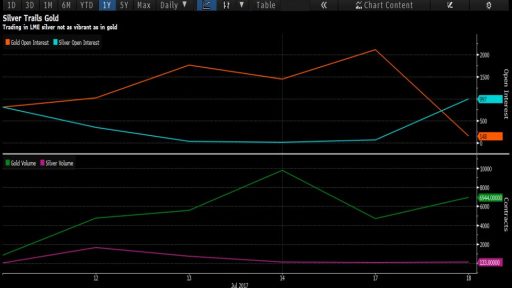

The London Metal Exchange’s silver contract is off to a slower start than gold.

Silver trading since the contract launched on July 11 has averaged about 782 contracts, compared with about 4,879 for gold, according to data from the exchange. On the Comex in New York, average gold volume is usually 3 times higher than silver.

“Gold had an exceptional start and silver had the more normal start you’d expect to see at a launch,” said Andy Pfaff, chief investment officer of Vanguard Derivatives, a South Africa-based broker. “I wouldn’t write it off over a bad couple of days. It’s common for silver trading to be lighter than gold because it’s a smaller market and there’s less demand for the precious metal, often called poor man’s gold. It can be difficult for exchanges to launch new contracts in commodities and recent gold products by CME Group Inc. and Intercontinental Exchange Inc. in Singapore have failed to attract regular trading.

“We’re not worried about silver, it’s very dependent on market activity and risk appetite,” Kate Eged, head of precious metals at the LME, said by phone on Monday. “Silver’s results probably look worse than they are because we had such a good week in gold. Open interest in spot gold was 2,110 contracts, compared with 61 in silver as of Monday.

The LME plans to expand in precious metals by adding futures and options for platinum and palladium by the end of the year. The activity in the LME’s contracts has attracted other participants including Bernard Sin, head of precious metals trading at refiner MKS (Switzerland) SA, who plans to start trading on the LME. He expects the firm will become a non- clearing participant.

“We want to get on as quickly as we can,” he said by phone from Geneva.

Spot silver rose 0.1 percent to $16.3114 an ounce at 2:26 p.m. in New York, heading for a fourth straight gain, according to Bloomberg generic pricing.

* Silver futures for September delivery settled 0.2 percent higher at $16.297 on the Comex in New York

* Gold for immediate delivery was little changed at $1,241.98 an ounce.

* Spot platinum and palladium declined

Source: Bloomberg Pro Terminal

Trader - S. Fuchedzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.