- Home

- >

- Daily Accents

- >

- USD Rates Signal Limited Price Action Expected Into Jackson Hole

USD Rates Signal Limited Price Action Expected Into Jackson Hole

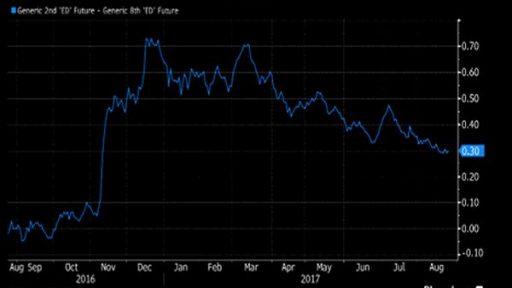

The U.S. rates options market is pricing a one-day straddle on 10-year swap rates with a breakeven of about 2.5bp, which is on par with previous non-event risk days, highlighting the small stakes traders hold before the Jackson Hole meeting, which is an academic symposium above all else.There is a marginal skew to the comments being read as slightly hawkish relative to market pricing given the deep pessimism seen in flatter Eurodollar curve moving further away from Fed’s expectations; The ED2-ED8, OIS pricing only 30% chance of Dec. rate hike and consensus for further USD weakness.

However, unlikely to be trend shifting and receiver spreads may still appeal given the low level of implied vols. The keynote Jackson Hole speech at 10am EST will be delivered by Yellen on the subject of “Financial Stability”

Given it is the keynote speech, the content should be closely tied to the conference theme of Fostering a Dynamic Global Economy; noting, last year Yellen included an policy section on “Current Economic Situation and Outlook” in a speech entitled “The Federal Reserve’s Monetary Policy Toolkit”

Short-dated implied vols typically rise in August with USD 1m10y seen increasing 0.38bp/day on average over the last five years; see seasonality here due to low summer liquidity coupled with annual August Jackson Hole summit and weak seasonality for the stock market

Upside for U.S. rates is limited over the summer and is unlikely to see a meaningful sell-off without concrete progress on fiscal reform.

Source: Bloomberg Pro Terminal

Trader - S. Fuchedzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.