- Home

- >

- Great Traders

- >

- Mark Mobius: “The U.S. stock market is set for a 30% correction that would wipe out the gains of the last two years”

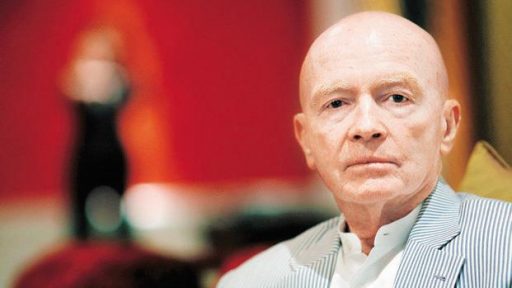

Mark Mobius: "The U.S. stock market is set for a 30% correction that would wipe out the gains of the last two years"

Mark Mobius, the 81-year-old investment guru, believes the U.S. stock market is set for a 30% correction that would essentially wipe out the gains of the last two years.

The renowned fund manager, who left Franklin Templeton, the American investment house, after more than 30 years in January, said “all the indicators” point to a large fall in the S&P 500 SPX, -0.85% and the Dow Jones Industrial Average DJIA, -0.82% .

“I can see a 30% drop,” said Mobius, who launched one of the world’s first emerging market funds. “When consumer confidence is at an all time high, as it is in the U.S., that is not a good sign.

“The market looks to me to be waiting for a trigger that will cause it to tumble. You can’t predict what that event might be — perhaps a natural disaster or war with North Korea.”

Mobius, who predicted the start of the bull market in 2009, has concerns that any fall would be amplified by the increasing use of exchange traded funds, which account for nearly one-half of all trading in U.S. stocks. His fear is ETFs would trigger further drops once markets fall.

ETFs represent so much of the market that they would make matters worse once markets start to tumble,” said Mobius in an interview. “You have computers and algorithms working 24/7 and that would basically create a snowball effect. There is no safety valve to prevent further falls, and that fall would escalate very quickly.”

Source: Bloomberg Pro Termina

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.