- Home

- >

- Daily Accents

- >

- GBP/USD: Factors we are tracking for potential trend-reversal

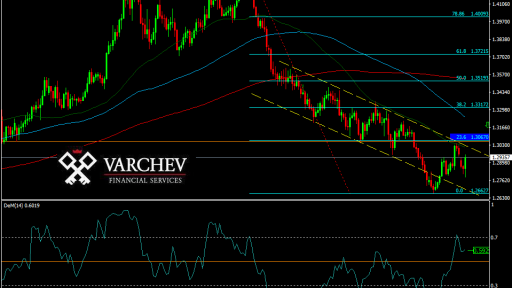

GBP/USD: Factors we are tracking for potential trend-reversal

Yesterday's news that the European Union will require less details from Theresa May's government on the future of the EU and the UK after Brexit caused the the euro and the pound to rally. Their break out, however, is still not decisive. Both the pound and the euro need additional supportive fundamentals before we see a reversal of the downward trend in GBP/USD and EUR/USD.

GBP/USD

As we described yesterday, if the pound-dollar does not break above 1.305, yesterday's upward movement will only be an impulse in the overall downward trend, making the strong upward move yesterday a signal for opening short positions: GBP/USD: Impulse or potential trend-reversal?

The pound failed to break the downward channel with yesterday's move.

In general, these levels are appropriate for opening a short position in the direction of the overall trend. However, we recommend that traders track today's auction of UK gilts from 12:45 pm Sofia time. The previous gilt auction realized 1,094% yield. If the positive news about Brexit in the last week actually had a positive effect on investors' sentiment, then this should be reflected in a higher demand for British government securities and hence a higher price for the securities (and hence a lower interest rate).

While these effects are not very pronounced in the short term (the effect of increased demand for government securities, for example, is seldom seen in hourly or 4-hour graphs), these factors are key to determining the overall long-term price direction.

Lower interest rates (hence, higher government securities prices) will show that the demand for instruments denominated in pounds is stronger. This is a strong signal of investor optimism when considering non-dollar government securities and other bonds.

Futures of British Government Bonds (gilt), daily chart

UK government gilts are in a short-term upward trend that is a part of the overall downward trend. The price forms a symmetrical ascending triangle. In the short term, increased demand for government securities is a negative signal for the economy: it shows excessive demand for safe havens and concerns about the economy.

In the longer term, however, especially when dealing with non-dollar government securities, the demand for and purchase of government securities (especially from foreign investors and foreign financial institutions) signals a positive sentiment towards the economy and the currency. This is visible on the weekly chart of gilt futures:

Gilt futures, weekly chart

After Brexit, for example, we see a strong sell-off of UK government securities. This is not a sign that investors are looking for more risky investments in Great Britain (for example, in the FTSE100), but rather that they do not have confidence in the British economy after Brexit.

This is an extremely important moment. The peak from before Brexith at about 124.5 was tested four times without a breakthrough. So, for us, the key factor for investor sentiment towards Brexit and the pound will be the demand for UK government securities. We will monitor the data of today's auction. And to determine the long-term trend we will be following the UK gilts to break the key resistances.

Key levels of gilt to watch for potential GBP / USD trend reversal:

1. Break out above 123: Breakouts above 123 will break above Fibonacci 50% resistance (about 122.6), as well as test the upper limit of the symmetrical triangle on the daily chart.

2. Test of the 124.5 level: At these levels, the market will try to reverse the downward trend from after Brexit and reverse the downward trend.

3. Convergence or divergence in the performance of UKX (FTSE100) and gilts.

Futures of long-term UK government securities (gilt) are available from the ICE Exchange.

Important fundamental factors:

Divergence in the performance of the price of gilts and the FTSE100 is bearish for the pound. If the FTSE100 falls while gilts are rising, it is a sign that investors are looking for risk-free investments because they do not believe in the economy and the stock market.

The policy of financial tightening is likely to continue after Mark Carney's mandate is renewed. This means we can expect a gradual rise in interest rates and hence a slight bearish pressure on UK gilts.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.