- Home

- >

- Daily Accents

- >

- Markets and events to follow for the EU-UK summit in mid-November

Markets and events to follow for the EU-UK summit in mid-November

Britain and the EU are preparing to announce a date for their meeting on Breskit: the meeting is expected to reach the final agreement for Brexith before the official departure from the UK on March 29, 2019. These are the markets, indicators and events, which we will follow.

Threats to Theresa May and the soft Brexit agenda

After the leave of Boris Johnson, one of the key figures behind the Brexith movement, the division within the Tory Party (the conservative British party) between hard Brexit and soft Brexit Tory-politicians became clear. Yesterday, the Euro-skeptic organization European Research Group has discussed mostly one topic: how to remove Theresa May to achieve a hard Brexit. Whether there will be a sabotage, considering that at this stage most British citizens would vote against Brexit (the latest data show), we will know as mid-November approaches.

The border between Northern Ireland and the Republic of Ireland

To date, the border between the Republic of Ireland and the UK is open as both countries are EU members. Under EU law, however, if Britain leaves the EU without an agreement to follow EU food safety regulations and others, the border will have to be controlled and the passage of goods levied with import tariffs.

The economies of the UK and the Republic of Ireland are closely linked. Checks on the passage of goods will stall trade between the two countries, and will complicate the production process for many businesses in Ireland and the UK.

GBP/USD: return of volatility, future BoE policy is still unclear

Volatility in the pound jumped over the past one month as the negotiations on Brexit approached.

The positive news surrounding Brexit in the past week managed to push the pound upwards to its resistance levels. We will probably see such cases of sudden jumps and falls in the value of the pound as the negotiations approach.

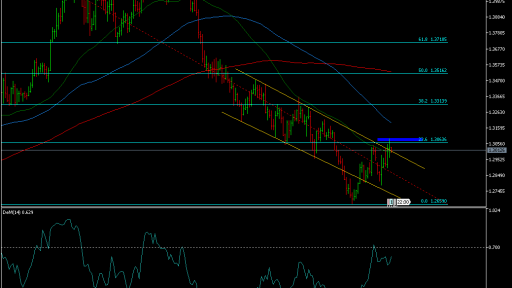

The GBP / USD failed to break the resistance around 1,306 and is currently testing a return to the downwards channel. Weakness in the DeMarker hinted at the potential failure of the move. A more detailed GBP/USD analysis:

GBP/USD: a weakening of bullish momentum, despite positive Brexit news

From a fundamental point of view, the weakening in the bullish impulse is logical. Bear in mind that Michel Barnier's statement did not contain details of any actual agreement. The agreement still has the chance to be detrimental to Britain: as the agreement between the US and Mexico last week showed, reaching an agreement does not mean that the pressure on the currency stops. Upon reaching the agreement between the US and Mexico, the USD / MXNjumped to over 19 from around 18.5.

European and British Pharmaceutical Companies

UK-based pharmaceutical companies are among the most prominent voices in reaching Brexit soft. The reason is that drug production is an extremely complex, long-lasting process that is most often dispersed between laboratories in several countries.

And funding for research on medicines for UK-based pharmaceutical companies often comes from EU funds.

After Germany, Britain uses the most European funds for research and development of medicines. Upon leaving the EU, this funding source is closed.

Financial industry

It can be said that Frankfurt is the city that benefited the most from Brexit. Frankfurt will probably become the center for clearing euro-transactions after Brexit. In addition, it is also expected that financiers in Frankfurt will be hired in the coming months, as many banks are reducing their workforce in London and increasing their teams in Frankfurt. These are the announced staff cuts in Great Britain by large financial institutions:

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.