- Home

- >

- Daily Accents

- >

- 2019: The year in which the US dollar’s volatility will return

2019: The year in which the US dollar's volatility will return

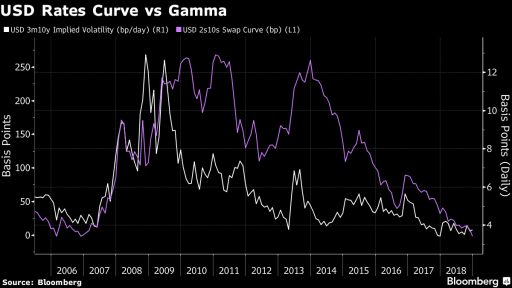

The high volatility moment for the US dollar is unlikely to happen before the yield curve goes up, which may not happen at least until the second half of next year.

During this time, systemic short-term volatility strategies will continue to reap profits from strong impulses in volumes, albeit lower than in recent years.

The relationship between the formation of the yield curve and the indirect volatility can also be found intuitively, meaning that periods of intense uncertainty cause the curve to climb upwards.

The equalization of the 10-year bond curve against the short-term is currently at around 40 basis points. This may change in the next year after the Fed changed its forecast for two key interest rates in 2019 and one for 2020. Turning the curve would suggest an increase in the risks of a recession in 2020, that historically this has always been a strong indicator.

Stock markets are beginning to shape as expected for a neutral monetary policy. The US central bank is changing its autopilot move to an economy-driven approach, hinting that the end of the aggressive move with interest rates is approaching. Early economic indications suggest that high interest rates create barriers. For example, they form a certain weakness in the housing market and in the automotive industry. These are the most sensitive to interest rate changes, while consumer sentiment is deteriorating.

Demand for short-term bond volatility is quite attractive and can improve any trader's strategy. Given the Fed's predictability, robust economic data and volatility.

Expected higher volumes will have to be supported by higher inflation, stronger macroeconomic dispersion, and a shift in FED's communication to market participants. Powell has to change strategy to keep pace with the movement of the economy, maintaining good-quality inflation to have a place to "breathe" in the fit of the new policy.

The interaction between interest rate increase and share sale will continue, as uncertainty about FED's neutral policy will be the main driver of future quantitative tightening.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.