- Home

- >

- Daily Accents

- >

- 2019 won’t be that good for the US dollar

2019 won't be that good for the US dollar

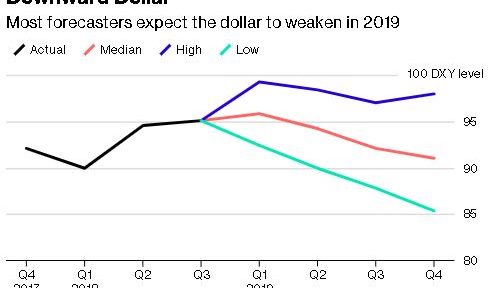

FX market strategists are preparing for the upcoming "dipping" of the dollar next year. Their hopes for a strong yen, however, are getting bigger.

The main engine driving the dollar down may be the slowdown in the US economy, mainly in the second half of 2019. This is predicted by JPMorgan Asset Management. Others predict that the Federal Reserve will slow down with raising interest, which is considered bearish for green money. The rise in market volatility and demand for capital outside the United States will also contribute to US cash outflows, according to Morgan Stanley strategists.

Whatever the reason, common vision and attitude is for a weakening dollar. "Green money" is over 10% to over 15% overvalued. A study conducted by Bloomberg among FX analysts shows the dollar is expected to lose positions against traditional safe heaven currencies such as the Japanese yen and the Swiss franc. The average forecast for the USD / JPY currency pair is the price to slide down from its current levels of about $ 113 to $ 108 by the end of 2019.

Let's not forget, however, that the expectations were also for a weak dollar in 2018, but the Bloomberg Dollar Index started its rally as early as April, along with the gradual rise in interest rates. The US economy was ahead of other countries, and the trade relationship between China and the United States had just begun to crack. The index for this year is up 4.1%.

Some analysts expect the dollar's appreciation to continue. This view is shared by Barclays Plc. They believe the rumors about the weakening of the dollar are greatly exaggerated. Their forecast is to increase the index by 2 to 3% in 2019, with most support behind this upward movement coming from raising interest rates in the first half of the year. Still, traders remain skeptical of these interest rises in 2019.

The Japanese yen may climb upwards if the Bank of Japan continues to weaken its control over Japanese bonds in the first half of the year. Yield may rise further with more balanced interest rates, which may encourage Japanese investors to start buying Japanese assets. Morgan Stanley remains bullish for the yen, predicting USD / JPY to reach $ 102 by the end of next year.

Scandinavian currencies also have a positive outlook for appreciation in 2019. The US Dollar against the Norwegian krone is one of Societe Generale's recommendations. They refer to the strong Norwegian labor market, high interest rates and the stabilization of oil prices. Breaking green money against the euro and the Swedish krona is Morgan Stanley's recommendation and is featured in their FX 10 business deals for 2019. They argue that the Swedish krona will become more attractive due to the current rate of interest rate rise by their Central Bank.

UniCredit also believes that the Swedish and Norwegian krona will have a rally in 2019. However, they expect limited upward movement unless the central banks of the two countries undertake a more aggressive move than investors expect.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.