- Home

- >

- Stocks Daily Forecasts

- >

- Strong evidence why this will be another good year on Wall Street

Strong evidence why this will be another good year on Wall Street

The US markets traded under the rhythm of a rap song that headed charts decades ago.

This is "Flo Rida's Market Structure" in the eyes of Jefferies' chief market strategist David Zervos. He said the eight heights that investors should pay attention to are currently: inflation, unemployment, interest rates, yield curves, volatility, issuance, spreads and volumes. Things are very similar to the song's chorus in which T-Pain says "Low" eight times.

"Deepening these bottoms over the next few months seems to be the most likely option," says Zervos.

Low inflation

The labor market is getting tighter, wage growth is picking up and there is still no sustained and sustained acceleration in price pressure. Option trading shows that the cost of inflation protection over 2% over the next two or five years remains relatively low in historical standards.

The effects of adopting a low inflationary environment are positive for the estimates of financial assets. A potential danger to markets is if this particular low-inflation brand also leads to pressure to cut margins if companies do not pass on rising labor costs to end buyers.

Low unemployment

The unemployment rate, currently 3.8%, is below the levels that the Federal Reserve considers to be sustainable in the long term for the past 18 months. The main conclusion for investors: In the last quarter of the century, large declines in stocks were rarely observed without a corresponding increase in initial unemployment claims - the highest rate read on the US labor market.

"Material changes in the economic landscape with low inflation / low unemployment seem very unlikely," Zervos writes.

Low interest rates

Expectations that inflation will remain low and the Fed will hold on from further tightening have led to a sinking US spending on loans. Ten-year treasury yields have fallen by more than 60 basis points since early November, and the curve of Euro-dollar futures implies almost a complete cut by the US central bank from now to the end of 2020.

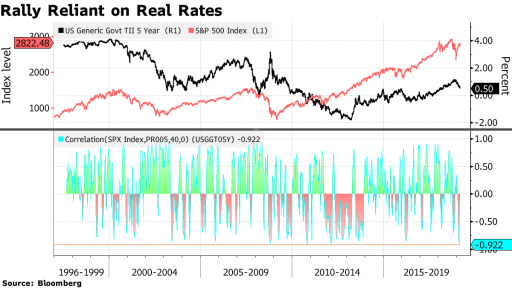

The fall in real interest rates gives a significant boost to stock ratings: the negative correlation between 5-year bond yields protected from inflation and the S & P 500 is at one of its most extreme levels in history.

Low yield curve

The gap between short- and long-term bond yields continues to grow - a sign of perceived economic instability over the medium term, even among the few conviction that the recession is ahead. At less than 15 basis points, the difference between the 10-year government bond yield and the three-month bond closed at its smallest levels on Friday.

"The yield curve is below 20 basis points for the fourth consecutive day," analysts from the Bespoke Investment Group write. "This is a series that is never seen in this cycle."

Weak issuance

Businesses, especially those who adhere to the rating of the investment class, may be prompted to continue with the "debt-based" diet to strengthen their creditworthiness, according to Peter Tchir, head of macro strategy at Academy Securities.

The new investment grade has declined modestly so far in 2019. The issuance of high-yield debt last year was the lowest since 2009, amid the tax changes for interest deduction and demand for leveraged loans. Even when sales of junk bonds rose in January, the market remains strong due to the strong appetite of trade flows.

Low volatility

The December nightmare was quickly forgotten, with the volatility of the various types of assets falling. One-month volatility measures in US stocks fell to levels that had not been seen since the record September of the S & P 500 and moved close to the lowest bond market.

Low spreads

The sum of all fears about the US credit market is approaching a five-year low, according to a recent Bank of America survey.

US credit investors have never been linked to market concerns about the risky risks reflected in the asset price of the financial markets at the end of the year, "says Hans Mikkelsen, head of the high-grade credit strategy at the firm. He recently upgraded his end-of-year forecast to show that investment grade spreads could be tightened further than current levels thanks to the "fairly favorable environment" introduced by the Fed.

Low volumes

Relatively dying activity - especially in the US equity index futures - is partly a function of the above factors: a symptom of these causes. Volumes tend to be lighter in quiet times and rise dramatically under stressful conditions. However, the lack of commercial activity also suggests the potential volatility of the market structure as the two turbulent outflows in 2018 were exacerbated by bad liquidity.

"In the near future there are really no potential catalysts for change," concluded Zevros. "In any case, all of these levels will not disappear at the same time, and there is actually a good chance all of them will stay with us by the end of the year."

Source: Bloomberg Finance L.P.

Original Post: These ‘Eight Lows’ Explain Why U.S. Markets Are Heading Ever Higher

Chart: Used with permission from Bloomberg Finance L.P.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.