- Home

- >

- Fundamental Analysis

- >

- The earnings season is off to a good start

The earnings season is off to a good start

The earnings season is off to a good start. So far, more than 78% of the S&P 500 companies that have reported have topped analyst expectations, according to FactSet.

Better-than-expected retail sales data also lifted sentiment on Wall Street.

Retail sales in the U.S. rose by 1.6% last month, the strongest gain since September 2017.

“The retail sales figures add to the slightly more positive tone of the recent data and provide some comfort that the economy isn’t falling off a cliff,” wrote Andrew Hunter, senior U.S. economist at Capital Economics, in a note. “But they don’t change our view that the fading of the fiscal boost and the lagged impact of the Fed’s monetary tightening will push GDP growth below its 2% potential pace over the coming quarters.”

However, Wall Street headed for a muted weekly performance amid a sharp decline in the health-care sector. The Dow and Nasdaq were up 0.6% and 0.2% for the week, respectively, while the S&P 500 was down marginally.

The health-care sector is down more than 4% this week as investors worry over proposals pushed by Democratic lawmakers. UnitedHealth CEO David Wichmann told analysts in a conference call earlier this week that propositions like “Medicare for All” would “jeopardize the relationship people have with their doctors, destabilize the nation’s health system and limit the ability of clinicians to practice medicine at their best.”

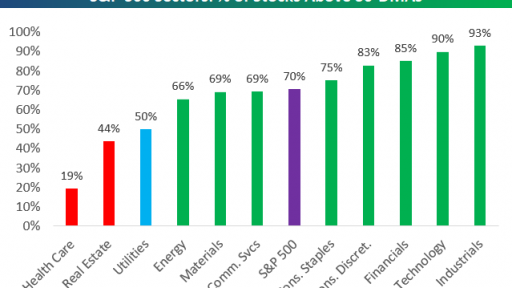

Shares of Regeneron Pharmaceuticals and HCA Healthcare led the decline in the sector this week, falling more 15.2% and 11.8%, respectively. The decline within the sector has been broad based, however. Nearly 80% of health-care stocks were below their 50-day moving averages. By comparison, 90% of tech stocks were above their 50-day averages.

Source: CNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.