- Home

- >

- Daily Accents

- >

- Bernanke: No hurry to hike

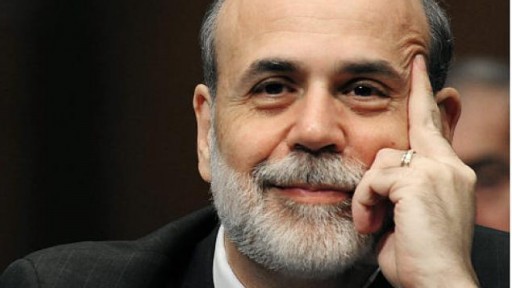

Bernanke: No hurry to hike

Former Fed Chairman Ben Bernanke told CNBC on Monday he sees no reason why central bank policymakers should rush to increase interest rates.

With the Fed considering a rate hike that would be the first in nine years, he said it's not evident that monetary policy is too easy because inflation is so low and full employment is only starting to emerge.

"The Fed has a 2 percent inflation target. It needs to get inflation up to that target," said Bernanke. "Easy money is justified by the need to get inflation up to the target."

In a wide-ranging interview on "Squawk Box," he also addressed criticism that the Fed keeps moving the goal posts for raising rates.

"As a form of forward guidance [in 2012], we promised we would not tighten until at least, at least until we got to 6.5 percent [unemployment report]. We didn't say we would tighten when we got to 6.5 percent," he said.

Reiterating the importance of the inflation target, he stressed: "The goal post was 2 percent inflation. We're not there yet."

Bernanke refused to second guess current Fed Chair Janet Yellen on her decision not to increase rates at the Fed's September meeting. "It is a tough call," he said, adding Friday's weak employment report for last month was a negative.

The debate on Wall Street has turned to whether the Fed might move at its next meeting, Oct. 27-28, or in December. But the futures market has basically ruled out this month and puts only 30 percent odds on December. The likelihood of a rate hike increases into next year, according to the CME FedWatch tool, which tracks daily market reaction on potential changes to the fed funds target rate.

Bernanke said slow productivity growth is weighing on the economy, and there's too much reliance on the central bank. He said other policymakers in the government need to step up.

The lower growth in the U.S. economy is not a hangover from the Great Recession, Bernanke said, noting that more capital investment is needed to boost growth.

In the long term, low or no inflation has risks, he warned. "If inflation is so very, very low that it's close to deflation, the risk is that ordinary interest rates will be low all the time. ... What happens where there's a recession, there's no where to cut."

However, he insisted that the Fed should not have hiked already. "That doesn't make any sense. If you raised rates too early and kill the economy, that doesn't help you," he said.

Bernanke was interviewed as the current Federal Reserve faces new challenges from a slowing China and whether the economic freeze there might put a lid on U.S. growth.

The China slowdown has been "broadly anticipated," he said, because of Beijing's move to more of a consumer-driven economy. He said the open question is whether the economy there is slowing more than one would expect from such as transition.

Investors shouldn't get too worried about the recent problems in Chinese stocks, he argued, because the market there doesn't relate too much to the economy.

Growth has certainly been slower around the world, but the U.S. economy has been doing better than others, Bernanke said, evidence the Fed's monetary policy since the financial crisis has been correct.

But he said no one can guarantee the Fed will foresee future bubbles.

"The Fed has been using easy money because the economy has needed a lot of support," he argued. "A better policy would be a better mix of monetary, fiscal, and other policies. The fact that the Fed is the only game in town means the Fed has to do too much."

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.