- Home

- >

- Uncategorized @en

- >

- 4 things to watch in the jobs report USA

4 things to watch in the jobs report USA

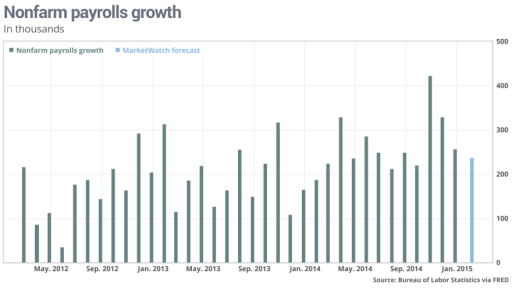

The job-creating engine of the U.S. economy probably cooled down a bit in February, but what Wall Street really wants to know is if a spike in worker wages at the start of 2015 shows staying power.

With the U.S. economy now spitting out more than 200,000 new jobs every month, the focus has turned to how much workers earn. The next step in any robust recovery after employment growth speeds up is an upturn in wages, but that’s been a missing link since the U.S. exited recession in mid-2009.

Here are four things to watch in the February employment report released Friday morning.

The headline number

The U.S. probably produced 238,000 new jobs in February, according to economists polled by MarketWatch. That would mark a small decline from January’s preliminary 257,000 gain and larger drop from the brawny 336,000 monthly average since November. But it would still be pretty darn good and extend a streak of 200,000-plus increases to 12 months, the longest string of such gains since 1994-1995.

The unemployment rate, meanwhile, is seen dipping to 5.6% in February from 5.7% in January.

What workers get paid

Every economy eventually generates faster wage growth as a recovery lengthens and strengthens. But that hasn’t been the case this time around. Hourly wages have risen at about a 2% annual pace since 2010, just two-thirds as fast as they grow historically.

Lately there have been signs that’s about to change. Just look at high-profile announcements by Wal-Mart WMT, +0.04% , Aetna AET, +0.33% and other big companies that they plan to give more money to their lowest-paid workers. And tech and manufacturing firms continue to complain about how hard it is to find skilled workers, a problem that’s also forced them to offer better salaries.

What workers get paid each hour jumped 0.5% in January to mark the biggest increase since 2008. That also pushed up the increase in hourly wages over the past 12 months to 2.4%, just a tick below the highest level in five years.

Yet until wage increases moves much closer to 3% annually, the economy is unlikely to grow much faster.

The weather wild card

Bad weather can play havoc with early efforts to figure out how many jobs were created. In 2013, for example, the government initially said the economy created 236,000 jobs. That figure was eventually boosted to 314,000 — a 33% increase.

This winter the weather was unusually warm from November through early January before turning much worse. Extreme temperatures or heavy snow make it harder for people to get to work and lead to temporary work shutdowns.

Some economists believe unseasonably warm weather through the early winter months exaggerated the job gains since November. Now it could be time for a little comeuppance.

Construction and manufacturing

Two industries that may have experienced a tougher month in February are construction and manufacturing.

The construction trade, for example, posted surprisingly strong job growth since November, at least in seasonally adjusted terms. But those gains could be partly illusory.

“From November to January, more than 600,000 construction workers normally lose their jobs because weather,” wrote economists at Citibank in a report. “But those months were so mild that far fewer workers were let go.”

In manufacturing, meanwhile, some 5,000 workers went on strike at major refineries in February. Along with bad weather, the strikes could put a dent in how many jobs the industry added last month.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.