- Home

- >

- Stocks Daily Forecasts

- >

- 6 reasons why the U.S. stock market is topping the world

6 reasons why the U.S. stock market is topping the world

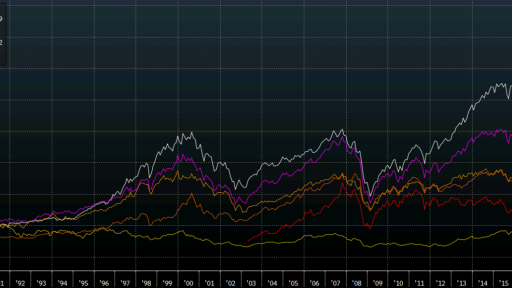

This is the celebration of the US Independence Day, and this chart should give Americans more pleasure than anything else.

It shows share returns since 1985 and the S & P 500 absolutely lubricates every other large global index. The only one that is even close is the MSCI World Index, and this is partly due to the fact that it contains a large exposure to US stocks.

Corporate America is indeed a world champion.

In the same way that Hollywood exports American culture and views, the representation of US stocks has led to exports and extrapolation of the profitability of long-term stock market investments. Be careful when applying them to other markets and applying them to the future.

This may indeed be a case of one-time American exclusivity. Here are six reasons why I think the US markets have crushed those in the rest of the world:

1) Technological dominance

If you return by the end of 2011 or in the mid-1990s, there is less limit between the US and the world. After these two periods, the technology was upward. By removing the contribution of the Internet and the dominance of technology, the success of the US has been greatly reduced.

This raises the obvious question why the US is so dominant in technology? Part of it certainly comes from scale and wealth. The United States has been a leader on the Internet from the outset and the huge wealth of the United States has created a culture of investing in technology start-up companies that have led to remarkable dividends. Either this or the amazing sums that the US government has invested in espionage and surveillance have been used to convey corporate secrets to US companies.

2) Globalization

Globalization is a one-time opportunity for US companies for new markets. It makes sense that corporations in the most competitive market in the world will be profitable when the whole world opens. US companies also have access to the easiest financing conditions through the US bond market. Finally, the US government is the most powerful in the world and has distorted and shaped the global landscape to satisfy its companies.

3) Taxes

Looking at the same period, it is characterized by declining corporate taxes and rising indirect corporate subsidies. I think that explains part of the difference. At the same time, corporate interest rates have fallen somewhere else without the same results, so everything is controversial, but I think that's at least part of the equation, but it may not be forever unless the deficit is reduced.

4) The role of the US dollar

The use of graphics, the great superiority of US stocks is even more impressive in some respects. The dollar rose 28% against the pound during this period. Even with a 17% rise in the yen, the S & P 500 still covered the Nikkei 225 many times. More importantly, trading the US dollar as a global trading vehicle makes it easier for US companies to do business globally.

5) English

This is something that is rarely mentioned, but English as a language has ascended for generations and has accelerated over the past 30 years. In practice, this means that if a US company is trying to manage workers or operate overseas, it is much easier than if a Japanese had to do the same.

6) Culture

On July 4 you will have to applaud the American entrepreneurial spirit. This is certainly part of this equation. Americans are diverse, but it is a country that attracts dreamers and entrepreneurs from all over the world. These are people who are not prone to risk. This is a country that is too often in the headlines for politics and not enough for what she has given to the world in terms of business, culture and technology.

Happy Independence Day!

Chart: Used with permission from Bloomberg Finance L.P.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.