- Home

- >

- Fundamental Analysis

- >

- 6 reasons why Trump better not start a trade war

6 reasons why Trump better not start a trade war

Better growth in the first quarter and low inflation can make things look as if it is now a good time for the US economy to survive a trade war, but Don Rissmiller, chief economist at Strategas Research, says there are six factors that he identifies, which show, the moment is inappropriate at all.

"I think the economy is fine, but do we really want to put it when we do not need it?" "said Rissmiller.

Here are six things that worry Rissmiller:

1. While GDP amounted to 3.2% in the first quarter, much of it, 0.7%, came from stocks or products and materials held by businesses. "Everything is fine, but if we look at the sub-components, things are not so pink, stocks are not the best way to grow," said Rissmiller.

2. A market reaction to the war meant tightening financial conditions, but the Fed is not ready to cut interest rates. The central bank just has pressed the "pause," and this pause is just beginning to have a positive effect on the economy. The Federal Reserve may eventually cut interest rates, but it would not do it preventively, just because of the worry that markets could be frightened or the economy affected by a trade war.

3. Inflation may be low, but "there are still signs that it is not dead," says Rissmiller. He said that increasing capacity utilization, wage increases, delayed delivery times for suppliers are a sign that inflation can return. Meanwhile, the bond market has not provided much protection against inflation, with 10-year yields below 2.5%

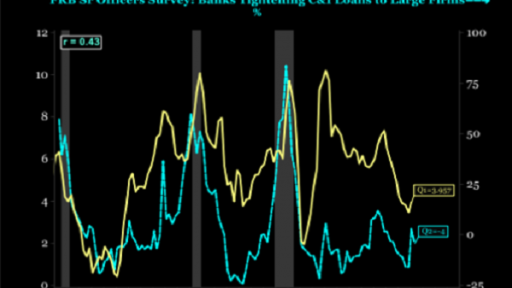

4. American bank lending standards, albeit still expanding, do not look so easy. Rissmiller notes that lending standards are a leading indicator of employment.

5. Employment declines and production is weaker. The Purchasing Managers Index in the US, measuring production sentiment, is on a downward trend following the global weakness.

6. Finally, the US budget deficit is high. Rissmiller said the intention to reduce taxes and incentives that blamed the deficit is to encourage corporate spending. However, if trade issues are unresolved, this could have the opposite effect, and CEOs and CFOs are reluctant to spend in an environment of uncertainty.

"This is the big pledge that we are doing against the economy through the tax code," he said.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.