- Home

- >

- Daily Accents

- >

- Sell in May and go away turns out to be a good idea if you don’t sell dollars

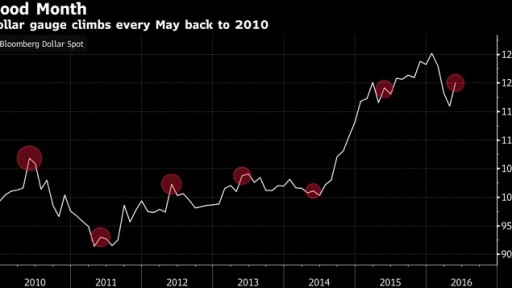

Sell in May and go away turns out to be a good idea if you don't sell dollars

Sell in May and go away turns out to be a good idea if you sold some of your other investments and bought dollars.

A Bloomberg gauge of the U.S. currency is on track to rise for a seventh straight May, after a parade of Federal Reserve officials including Chair Janet Yellen hinted at higher U.S. interest rates as soon as their gathering on June 14-15.

The yen and Australian dollar have been the biggest casualties among developed-market currencies, with the Bank of Japan and Reserve Bank of Australia each having the opportunity to add to stimulus at policy meetings next month.

Union membership, a general election in Spain and Japan’s decision on its sales tax.

“The dollar has done well in May, but right now we are not focused on dollar-centric risks, given the dense data and event-risk calendar in June,” said Ned Rumpeltin, the European head of currency strategy at Toronto Dominion Bank in London. “While we are paying close attention to the dollar driver, we are also keeping careful tabs on what is unfolding on the other side of the trade.”

The U.S. currency was little changed Tuesday at 111.07 yen as of 7 a.m. New York time, after reaching a one-month high of 111.45 Monday. It’s gained 4.3 percent versus the yen in May, appreciated 2.7 percent against the euro to $1.1151, and strengthened 4.9 percent to 72.44 cents per Australian dollar.

Bloomberg’s Dollar Spot Index, which tracks the currency against 10 major peers, has risen about 3.5 percent this month, its best May performance since 2012. The U.S. currency has appreciated against 15 of its 16 major peers this month.

Futures trading indicates a 54 percent chance the Fed will raise interest rates from the current range of 0.25 percent to 0.5 percent by July, compared with 26 percent odds a month ago.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.