- Home

- >

- Daily Accents

- >

- A $30 billion hedge fund identified a potential trigger for ‘the next financial crisis’

A $30 billion hedge fund identified a potential trigger for 'the next financial crisis'

Baupost Group, a $30 billion hedge fund, has laid out a road map for market chaos.

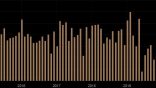

In a second quarterly private letter that was reviewed by Business Insider, Baupost said that the problem lies with a signature feature of current markets: low volatility.

That low volatility could be the harbinger of a crisis to come.

That's because when there is low volatility, investors tend to take on more leverage – borrowing money to juice bets – which could trigger problems later on.

"While leverage is not directly responsible for every financial disaster, it usually can be found near the scene of the crime," Jim Mooney, Baupost's president and head of public investments, wrote in the letter. "The lower the volatility, the more risk investors are willing to or, in some cases, required to incur."

To be sure, Mooney cautions that investors can't know whether an uptick in volatility is "imminent or even inevitable," nor that it would necessarily have cataclysmic effects, "although it certainly could."

"We remain in a market that is broadly expensive and largely indifferent to risk," Mooney wrote in closing the letter. "No one should be lulled into a false sense of comfort by the illusion of stability which surrounds us."

Mooney's warning contrasts with the VIX, an index measuring investors' fear. Last week, the index hit its lowest level in 24 years, a sign of investors' confidence in the bull market.

Source: Bloomberg

Junior Trader Stefan Panteleev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.