- Home

- >

- Daily Accents

- >

- A Brexit story: Tracking the financial consequences

A Brexit story: Tracking the financial consequences

Brexit's policy remains an entire decimation enigma, leaving only two weeks until the deadline for Britain to leave the European Union. Meanwhile, the financial markets assess the uncertainty of the most unexpected places, including the rise in the cost of financing insurers and banks, lower stock valuations and higher interest rates for the so-called " class junk bonds. Below we can track where the "pay" of the Brexit price is most affected.

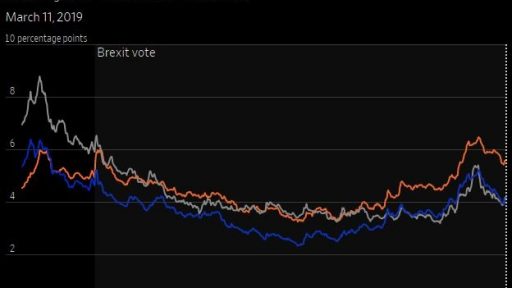

Higher lending premiums

Those who hold funds with a lower credit rating are vulnerable to the unknowns that Brexit creates. High yield corporate bonds typically pay about 5.6% more than UK government bonds. For comparison, the US yield was 4.2% and 4.1% for the Eurozone. Investors are mostly mindful of lending to highly lenient UK companies: This year, we are seeing rallies in credit markets, and spreads on high-yielding sterling bonds have narrowed to as much as high-yield bonds in euro and US dollars.

US companies are not immune

US companies and banks are experiencing higher prices in borrowing English bonds. Take Citigroup for example: the spread of their $ 788 million pound bonds maturing in 2026 is 1.5% versus 1.1% for $ 2 trillion dollar-denominated US dollar bonds that mature over the same year.

Insurers feel the consequences

It is becoming more and more expensive for companies like those in the insurance sector to borrow in euros in pounds. For example, the spread of the 30-year bonds of British issuer Aviva Plc issued in 2013 now have a wider spread than those issued in 2011.

Foreign investors are a factor influencing weaker demand for British assets.

British banks pay more

The cost of borrowing funds rose over the past year because many European investors were "unloaded" from bank bonds. Brexit's premiums have fallen in recent weeks due to the declining likelihood of a Brexit no-deal. Higher lending rates may have an impact on consumer demand and on companies, leading to higher lending rates, although British banks have significantly reduced their dependence on debt markets since the end of the financial crisis. The spreads of Lloyds Banking Group and Societe Generale are flat to almost 0.6%

The effect of Brexit on the shares

Abstain from the weak pound effect and the UK shares will reveal the real weight of Brexit. Explained in dollars and tracking the way more international investors operate, the FTSE 350 is at those levels that stood in 2016, while the S & P500 is up 34% and Euro Stoxx 8%.

Investors are now paying less for UK shares than they were paying until three years ago. Compared to companies' predictions, stocks fell into the culmination of the referendum, but continued to trade around their bottom.

Largest Brexit Barometer

Pounds drastically lost their value after the referendum vote on 23.06.2016. Since then, the currency has begun its climb when soft Brexit comes in, but has faded as EU-UK ties have strained. The pressure from Parliament to reject the no-deal Brexit - turned the pound into one of the best-performing currencies of the G-10 group this year.

Source: The Wall Street Journal

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.