- Home

- >

- Fundamental Analysis

- >

- A brief market overview

A brief market overview

U.S. stocks headed for a three-week low as concern that global growth remains tepid sent equities lower from Europe to developing nations. Crude wiped out an advance, while the dollar strengthened for a second day after falling to the lowest in almost a year.

S&P fell for the fourth time in five days, with industrial shares losing more than 1 percent as an 18 percent run from February lows faltered.

European shares slid a fourth day as earnings failed to lift investor sentiment.

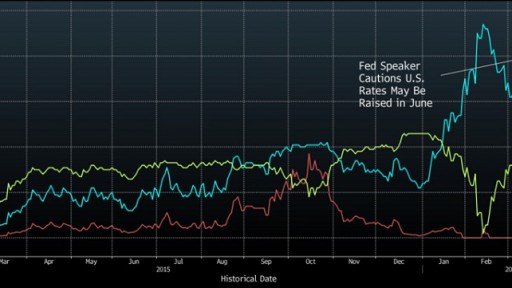

Emerging-market equities sank and the dollar climbed from a June low amid speculation on the timing of higher interest rates.

Futures show nearly 90% chance of no action from Fed next month

The rally in global equities stumbled into a second week as data from Europe to America failed to alleviate concern that economic growth is slowing and corporate profits will contract. At the same time, comments from Federal Reserve officials raised the specter for higher rates even as economic reports paint a mixed picture on the state of the world’s largest economy ahead of a government jobs report Friday.

Bank shares fell a second day, while energy and raw-material producers -- the two strongest groups as stocks rebounded from a February low -- lagged for a third session.

The Stoxx Europe 600 Index was down 1.1 percent, with all industry groups falling.

The MSCI Emerging Markets Index of stocks fell 1.2 percent to the lowest in a month.

Dollar index hits session highs.

The greenback added 0.4% vs. yen and not much change vs. euro.

Japanese Finance Minister said Tuesday, when the nation’s currency reached an 18-month high, that the government is monitoring speculative foreign-exchange trades and will respond if needed. The yen has strengthened more than twice as much as any other major currency in the past week as the Bank of Japan unexpectedly refrained from adding to stimulus at a policy review.

Gold slid a third day, as the dollar’s rebound dimmed the metal’s appeal as an alternative investment.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.