- Home

- >

- Great Traders

- >

- A hedge fund billionaire says there are only 2 things you need to remember about investing

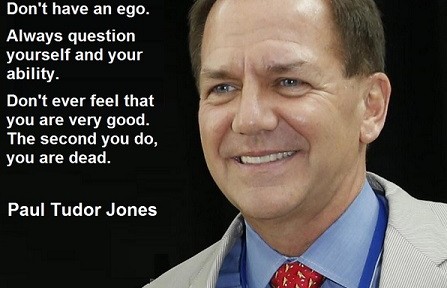

A hedge fund billionaire says there are only 2 things you need to remember about investing

There's more than one way. The stuff Paul Tudor Jones has made his billions based on does not appear in any traditional investing textbook.

For example, the idea of being on the right side of a predominant trend — bring a concept like this into the Church of Value Investing and you may see the holy water begin to boil. And yet, it can work if applied correctly.

Here’s PTJ on his own chosen trend indicator, the 200-day moving average. One principle for sure would be: get out of anything that falls below the 200-day moving average.

I teach an undergrad class at the University of Virginia, and I tell my students, "I'm going to save you from going to business school. Here, you're getting a $100k class, and I'm going to give it to you in two thoughts, okay? You don't need to go to business school; you've only got to remember two things."

The first is, you always want to be with whatever the predominant trend is. My metric for everything I look at is the 200-day moving average of closing prices. I've seen too many things go to zero, stocks and commodities. The whole trick in investing is: "How do I keep from losing everything?" If you use the 200-day moving average rule, then you get out. You play defense, and you get out. We run a tactical model in-house that is designed to respect trend and omits the kind of touchy-feely pseudo-intellectualism that often accompanies market or economic prognostication. Part of this is because there is no Why. Trends are confirmed or violated as a result of the process by which markets attempt to figure out the Why, in real-time. When the crowd feels confident that it's got the What and Why figured out, a trend solidifies. When this confidence is shaken — in either direction — a trend becomes invalidated and a new trend is born.

Тhe kind of trading that Tudor does would be wholly inappropriate for wealth-management clients, but it is remarkable how universal this idea of respecting trend can be — and how versatile when applied to lower-turnover strategies.

Incidentally, after eight months of consolidation, the US stock market's primary trend is now flat. This can be a confusing time for people without a plan, people who are looking to headlines for guidance. Doing so with one's own money is one thing, but with other people's money?

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.