- Home

- >

- Cryptocurrencies / Algotrading

- >

- A libertarian fantasy about cryptocurrencies

A libertarian fantasy about cryptocurrencies

"Digital money must be subject to serious regulation, not to protect itself by talking nonsense about innovation." - Martin Wolf

"Move fast and bring chaos." - The famous motto of Mark Zuckerberg, the founder of Facebook. Among this chaos that has reigned for violated norms and rules of trust that are essential to democracy. Just as democracy as a part of politics relies on trust as well as activities related to finance and money. That is why development in these directions should not be left to the greed and fanaticism that we observe in the world of crypto. It is necessary to make careful judgments between the two worlds - the already existing finances and the digital world. Surely change is coming. But you should not let it happen.

Of course, the movement that supports the crypto will deny this because its roots are deep in anarchist libertarianism, as the notorious Nouriel Roubini says. This ideology rages in the minds and hearts of many entrepreneurs in Silicon Valley. They are right. The state can be a pretty scary monster. But it, the state, is also vital: it is the greatest security mechanism of mankind. The world of anarchy is a world of bandits in constant competition. Liberal democracy helps to curb these thugs. Countries have to provide vital goods. Money is a public good according to its purpose. That is why revolting against the role of government and money is pure fantasy. The story of the so-called crypto rising demonstrate this rebellion.

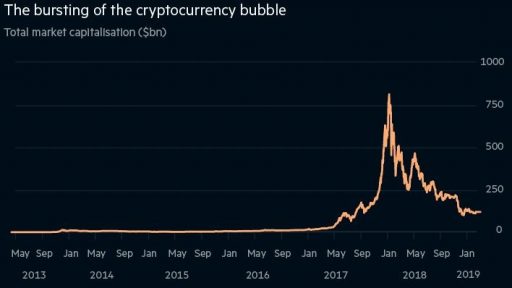

Money is to keep value, a valuation unit and a means of exchange. For a currency to be really good, it must be durable, easy to translate, recognizable, acceptable and limited in supply. How do the cryptocurrency manage to get closer to these requirements? They are definitely not a means of preserving value, nor a good means of valuation, as the aggressive price movements show. They are not a good means of exchanging because the majority of people and businesses who hold a lot of legalized things do not agree to own something that is wrapped in anonymity, unachievable, which is an ideal for criminals, terrorists and a means of washing money.

The best way to describe the use of crypto is to simply collect coins for speculation. A cryptocurrency will only acquire real value if it is adopted by a particular jurisdiction. Yet, there is an exciting reason why, under normal circumstances, people use the currency of their government: they have to pay their taxes. In order to do so, they have to pass money to the government bodies that they accept. The state without a problem imposes this obligation. Accordingly, if you do not pay taxes, the state will hold you responsible. Therefore, it imposes an internal monetary monopoly.

At present, crypto-latitudes have only created perfect conditions for criminal activity, financial bubbles, deceived investors, grotesque exploitation of electrical and computer energy for the so- "mining", which only helped fund fraud and tax evasion. How much social value do we see here? There should be no meaningful and positive preconditions for creating anonymous currencies. Cryptocurrencies are not that important yet. But they need a healthy regulation. Voices are innovation and freedom are no longer enough.

Whatever the hazards of crypto, the technology behind them, Blockchain, can be quite useful in many areas of economics, finance, and technology, making them more effective and secure. A number of experiments and experiments are conducted with the technology. According to the Geneva Report - Impact of Blockchain Technology on Finance - it is clear that Blockchain technology can mitigate the "cost of trust" and thus cut costs altogether, lower prices, economic rents, and create a more secure and fair financial system. This will certainly be welcomed. However, the basic public requirements for transparency and financial stability should not be overlooked.

Replacing ordinary money with digital tokens would be relatively easy. Basically, this replacement will raise the question of the extent to which they will be anonymous. Not to mention the far greater risks that will be found for revolution and destabilization of the system as opportunities if the masses could move from deposits in commercial banks to fully secure deposits of the Central Bank to apply the digital currency. This radical idea is very tempting, and that is obvious. It is tempting because this will remove the privileges of specific people from classes of business and banks to government. But it will also transform (and certainly make it unstable) today's monetary system in which the state seeks a way to guarantee and regulate cash flows that are created mostly by private banks secured with private debt. The revolutionary thing, however, is that it will now be easy for everyone to have an account and a deposit with the Central Bank. Technology eliminates this historical difficulty.

As elsewhere, innovation transforms monetary opportunities. But not all changes are for the better. Some are obviously bad. The right way forward is to reject the libertarian fantasy, but not to change itself: our monetary system is too flawed for such a phenomenon. We have to adapt. But history reminds us that we need to adapt very carefully.

Source: Financial Times

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.