- Home

- >

- Uncategorized @en

- >

- A sharp change in ECB policy can shock the economy

A sharp change in ECB policy can shock the economy

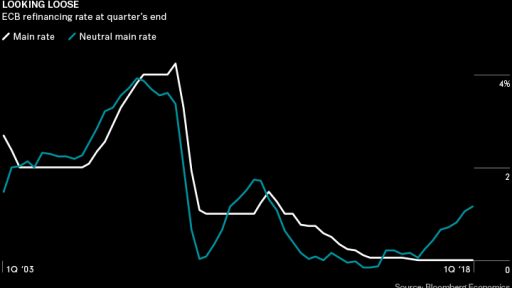

Compared with the estimated neutral rate of around 1,5%, the effective ECB main rate is 0-0,25%. The idea behind the neutral rate is that it balances the inflationary and the deflationary pressures in the economy. In this way growth with stable price levels is achieved. The difference of 1,25% between Bloomberg's estimate and the actual rate shows that the ECB's policy is too loose for this stage of the economic cycle.

The risk for Europe is that if inflation accelerates faster than the ECB predicts, then the central bank will have to sharply shift its policy stance: from extremely loose and aiming at reaching the 2% inflation level, to extremely restrictive and aiming to tame the inflationary pressures in the economy. This risk is especially potent if next year, after Mario Draghi's mandate expires, Jens Wiedmann becomes ECB president, who is likely to focus more on inflation-control at the expense of economic growth. This sharp shift in policy can surprise the financial markets, as well as the end-consumer. This can prove to be a major shock to the economy.

Chart: used with permission from Bloomberg Finance L.P.

Trader Velizar Mitov

Trader Velizar Mitov If you think, we can improve that section,

please comment. Your oppinion is imortant for us.