- Home

- >

- Daily Accents

- >

- A startup asks financial companies to help it build a database of signs a trader could go rogue

A startup asks financial companies to help it build a database of signs a trader could go rogue

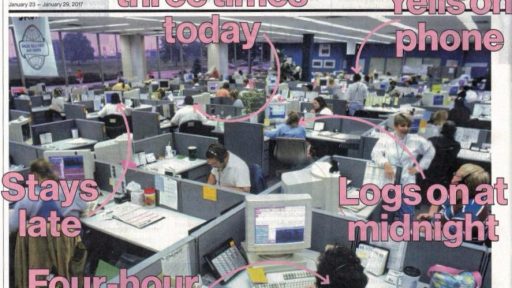

You’re young and want to get ahead. First in and last out of your Wall Street office. You work weekends and message colleagues with trading ideas at all hours. Guess what? You’ve just ticked off some of the boxes that may mark you as a potential rogue trader.

Former Goldman Sachs research analyst Erkin Adylov is building a library of trader behavior, based on case histories of hundreds of past miscreants, for banks looking for red flags. Using thousands of inputs, including stress levels in voice recordings and the frequency of visits to the staff canteen, Adylov and his team at London-based startup Behavox grade employees on how likely they are to go bad before they do anything wrong.

Hedge fund Marshall Wace and inter dealer broker TP ICAP are already using the software to monitor employees, and some of the biggest investment banks and commodities dealers in the world have begun testing it. After paying fines of more than $200 billion in the past eight years for a catalog of failings-money laundering, market manipulation, terrorist financing-banks are looking to improved trader surveillance to keep them out of regulators’ cross hairs.

“If you don’t know what your employees are doing, then you’re vulnerable,” Adylov, a rail-thin, 33*year old native of Kyrgyzstan, says in the rapid staccato typical of traders. “Some banks don’t seem to want to know how exposed they are,

and they are the ones who are going to get fined next.”

Finance companies are spending as much as one-fifth of their revenue on compliance, hiring tens of thousands of investigators, out-of-work traders, and former intelligence officers to sift through employee communications. Under rules that came into effect in March 2016, senior managers in the U.K. can be held accountable for the actions of their underlings and even face jail sentences.

Behavox uses machine learning, also known as artificial intelligence, to scrutinize every aspect of an employee’s working life. Finance workers’ activities-from e-mails to ID card swipes-are already frequently logged. The technology allows computers to teach themselves how to collate and analyze huge volumes of data, flagging for further investigation anything that deviates from the norm for individuals or their peer groups. This could be something as seemingly innocuous as shouting on the phone, tapping into a work computer in the middle of the night, or visiting the restroom more than colleagues.

The system checks these behaviors against case studies of past traders who have strayed from the straight and narrow. Behavox has built algorithms derived from 16 years of publicly available enforcement cases against traders and banks all over the world. After detecting anomalous conduct, it gives it a risk score based in part on that person's past record of compliance with the rules. It also maps relationships among employees and flags potential problems, such as a trader having a particularly close relationship to someone in the back office who monitors trades.

While other companies use similar technology to watch trading floors, Behavox is compiling a central repository of behavioral patterns accessible to all clients. Adylov calls it the conduct risk exchange. When a client discovers an employee has done something wrong, Behavox encourages the firm to share details on an anonymous basis.

His challenge is to persuade companies to share potentially embarrassing information about their inner workings. If he can build a network big enough-more than the three companies that have signed up so far- it could change the way banks police themselves. “With this system, users benefit from eyes and ears across the industry and the behaviors that are being spotted and fed into it,” says Conor Kiernan, chief technology officer at Marshall Wace in London. “It really doesn’t pay to be insular when it comes to compliance.”Secrecy isn’t the only hurdle Adylov

None of that daunts Adylov, who's no stranger to adversity. Born in a small town in what was then part of the Soviet Union, he was a goatherd until he won a George Soros grant at the age of 16 to study in the U.S. for a year. Adylov worked four jobs to fund his studies, including one as a gardener for money manager Clinton Bidwell III. Impressed with Adylov’s intelligence and charm, Bidwell took him on as a research assistant. The complexity and technical nature of the job appealed to Adylov, and soon the only thing he wanted to talk about was company stocks. “It was almost like 1 discovered a new world that I didn’t know existed,” Adylov says.

He won a scholarship to the London School of Economics and Political Science, after which he joined Goldman Sachs in 2007 in London as an equity research analyst. Fast- forward seven years, and Adylov was a top money manager at hedge fund GLG Partners. He then decided he wanted a less predictable career, and he set up Behavox in 2014 from his apartment in South London.

Turning some compliance functions over to software could help financial companies save money. “Even if regulations are relaxed, the business case for reducing the expenses of compliance will remain very compelling,” says Mike Baxter, a partner in Bain & Co.’s financial-services practice. But Adylov’s ambitions go beyond cost efficiency. Banks today are “all over the place, all doing compliance differently, with no way to collaborate,” he says. “These guys just can’t solve the problem on their own.”

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.