- Home

- >

- Daily Accents

- >

- After Brexit the prospects for the british pound are negative.

After Brexit the prospects for the british pound are negative.

Weaker demand, slower growth, faster inflation -- that’s the U.K. economy at the momment.

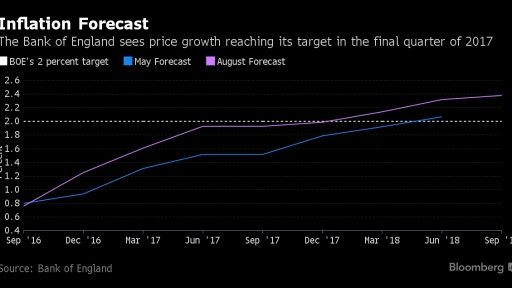

The most marked and sustained impact of Brexit on markets was the exchange rate, and that’s a worry for an inflation-targeting central bank like the BOE. Releases on Tuesday will provide an insight into how fast the pound’s 12 percent decline on a trade-weighted basis is driving up consumer prices. Over the medium term, the BOE expects weaker sterling will push price growth back to its 2 percent target at a faster pace than previously envisaged.

While economists see the headline inflation rate staying at 0.5 percent in July, prices of products from cars to phones have already started creeping higher as firms pay more for imports.

The BOE forecasts unemployment will rise to 5.5 percent at the end of next year from 4.9 percent currently.

A faltering job market combined with an upswing in prices could hit a crucial part of the economy: domestic spending. That key driver of growth has so far proved resilient. Even with consumer confidence dropping, the British Retail Consortium said that retail sales rose the most in five months in July.

The ONS will give its take on Thursday with July retail-sales numbers that are forecast to show stagnation. June saw a 0.9 percent drop, the most this year, and a BOE survey showed household spending was starting to wane even prior to the EU vote.

The week ends with the latest snapshot of the public finances. We’re four months into the fiscal year, and new Chancellor of the Exchequer Philip Hammond is dropping heavy hints that government stimulus is on the way to back up the BOE’s monetary easing.

July is usually a good month for the public finances, with the Treasury receiving higher-than-normal receipts of income tax and corporation tax. Economists predict a budget surplus of 1.9 billion pounds ($2.5 billion), up from 1.2 billion pounds in July 2015.

But Brexit will likely take its toll before long. According to independent forecasts compiled by the Treasury last month, the deficit will total 129 billion pounds between April 2016 and March 2018, a third more than officials predicted in March.

The BOE said this month that if the U.K. economy develops as weakly as it predicts, policy makers will probably cut their benchmark interest rate again.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.