- Home

- >

- Cryptocurrencies / Algotrading

- >

- Algo hedge funds also “guilty” for the sudden bitcoin surge

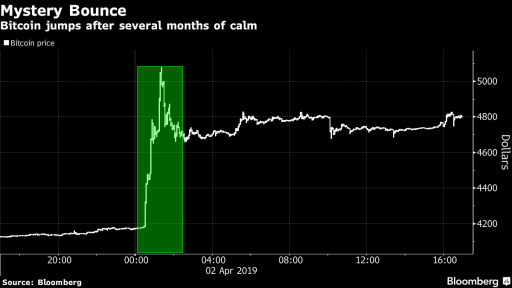

Algo hedge funds also "guilty" for the sudden bitcoin surge

Add algorithmic hedge funds to the list of suspects behind the sudden rise in bitcoin on Tuesday, which has made real digital currency fans believe in the so-called " The "Renaissance" period of the cryptocurrencies

Recent trends indicate a strong growth in this type of computer strategies, which was initially seen as focusing on the retail market.

The number of algorithmic traders jumped drastically over the past 7 months, with 17 algo and quantitative funds being launched since September, according to Crypto Fund Research. They represent more than 40% of the Crypto hedge funds launched during the same period.

More than the 20 percent rise of bitcoin in less than an hour at the start of the Asian session on Tuesday most likely triggered automatic software that was set to execute over $ 100 million in three exchanges, according to Oliver von Landsberg-Sadie, chief executive officer of the BCB Group.

Rather than relying on human action, these funds use automated software that notices and sometimes buys on certain events in the markets around the clock. Some perform thousands of deals a day while others trade once every two or three days and make money through price arbitrage. While the Cripto hedge funds generally lost nearly 72 percent during the crash last year, some algo funds recorded profits of between 3 percent and 10 percent per month in 2018.

"Some people think that algorithmic trading is a tool for manipulation, others believe it makes markets more efficient," Landsberg-Sadie said. "I'm definitely the second guy."

Source: Bloomberg Finance L.P.

Chart: Used with permission from Bloomberg Finance L.P.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.