- Home

- >

- Market Rumours

- >

- Another big alarming sign yet that investors are bracing for a stock market crash

Another big alarming sign yet that investors are bracing for a stock market crash

Sharp sell-offs have occurred with frightening regularity, and investors haven't seemed particularly inclined to buy the dip. Yes, there have been relief rallies after large pullbacks, but equities haven't been recovering as quickly as they once did. And they certainly aren't bouncing back to record highs.

The reluctance of investors to scoop up shares at discounted prices shows just how nervous they are about the future of the market. And this past week we got the latest sign that they're bracing for an imminent stock meltdown.

Bank of America Merrill Lynch found that traders pulled a whopping $27.6 billion out of US equities in the week ended Dec. 12, the second-biggest outflow of all time. And the trend was no rosier on a global basis, as a record $39 billion was yanked from stocks worldwide, the data show.

While the numbers themselves are eye-popping, it's the fact that they're so historically dire that should have people very concerned. Overall, it indicates extreme trepidation amongst investors. And, given the confluence of negative factors weighing on the market right now, you can hardly blame investors.

They're still worried about the fallout from President Donald Trump's trade war, a potential global growth slowdown, the pace of Federal Reserve tightening, and new vulnerabilities in tech stocks. And those are just the headliners. Many more minor headwinds lurk under the surface.

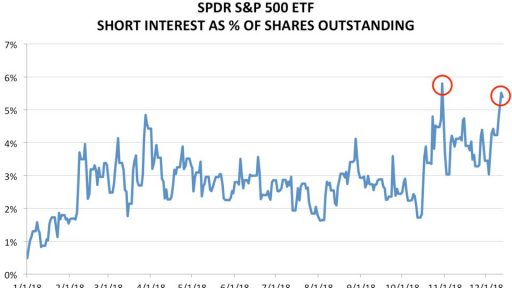

If, for some reason, BAML's outflow data hasn't convinced you of the nervousness pervading the market, consider that bearish bets against the S&P 500 are at their second-highest levels all year. This is reflected in the level of short interest for an exchange-traded fund tracking the US equity benchmark.

Adding to confusion is the fact that experts are sending mixed messages. On one side, you have someone like Leuthold Group chief investment officer Jim Paulsen. He's largely bearish and recently argued that a crash may be the only thing that can completely hit the reset button on the market's biggest problems.

Then you have the collection of Wall Street equity strategists, who aren't necessarily ready to bail on the US stock market quite yet. Sure, most of them think 2019 will be the bull market's last hurrah, but even the most bearish one — Mike Wilson of Morgan Stanley— forecasts that equities will rise next year.

Ultimately, if one thing is clear right now in the US stock market, it's that investors are seeking shelter now and asking questions later. It's a prudent approach, considering the nearly 10-year bull market will have to meet its demise at some point, and we're currently getting some of the strongest signals yet that a collapse is near.

Source: BI

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.