- Home

- >

- Stocks Daily Forecasts

- >

- Another blow to the European banking sector creates opportunities for a trade

Another blow to the European banking sector creates opportunities for a trade

China's HNA Group, the largest investor in German Deutsche Bank AG, said it plans to sell its entire stake in the German bank under pressure from German regulators who are trying to reduce the participation of Chinese companies (sponsored by the Chinese government) in European companies. The decision came after the Chinese government asked HNA to focus on managing its airline. HNA Group owns 8% of Deutsche Bank's shares.

This exacerbates the problems of Deutsche Bank, whose shares have fallen by 39% this year, and the bank is currently restructuring for the fourth time in the past three years. Following the announcement of the stock, the shares fell by another 2%.

This is another blow to the European banking sector, which has not recovered even 10 years after the financial crisis, unlike the American banks that are on the rise. At this stage, short positions in Deutsche Bank are not attractive despite the negative news.

Given the historically low prices of the company, Deutsche Bank's future is likely to be redeemed by another large bank or financial institution: despite its problems, the bank has been concentrating in the past year on attracting young, educated staff. This selection of young talented financiers makes it attractive to prospective buyers, despite the many in-house troubles in the German financial giant.

A more attractive short position is offered by Commerzbank AG, the other large German bank with weak performance since the beginning of the year.

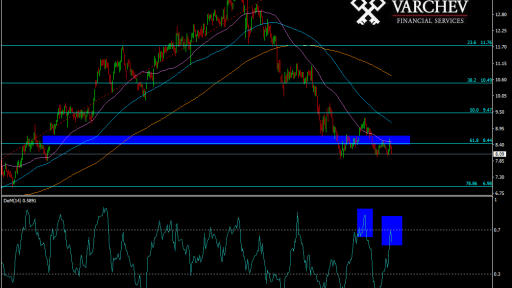

The price is trying to break the Fibonacci resistance of 61.8% around 8.5 euros. This level coincides with the 50-day MA, the previous peak, as well as the March 2017 mark. The price fails to break and returns to the overall downward trend. DeMarker tries a break above 0.7, but fails, confirming the downward trend.

Entry: Short position around 8.10-8.20 euros.

S/L: 8.63; 5-6% maximum loss.

We expect support for the price of around 8 euros: round number and three previous bottoms. The next Fibonacci support for the price is around 7 euros, which coincides with the bottom from mid-February 2017.

Alternative scenario: If the price fails to break below 8 euros, the downward trend is weakening and the bearish scenario is rejected. The categorical rejection of the bearish scenario is a daily close above 8.5.

Source: Bloomberg Finance L.P.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.