- Home

- >

- Fundamental Analysis

- >

- Another “postponement of the end of the world” led to imploding of defensive assets

Another "postponement of the end of the world" led to imploding of defensive assets

For almost a year now, investors are shaking in the shadow of fear. Because of the trade war and the slowdown in the global economy, investors believe that everything will end in the form of a recession. Assets like gold and government securities provide protection. However, in Thursday's session, this escape process ended in a rather impressive way.

Gold lost more than $ 30 in value, government securities fell to their summer levels, and defaults went down.

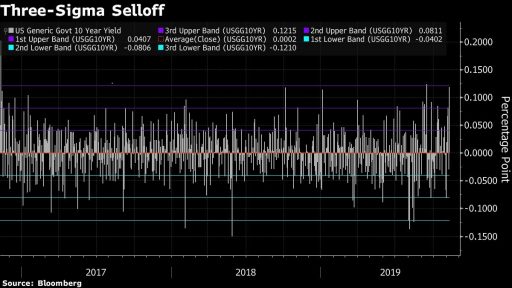

Government securities around the world have plunged, with yields on 10-year US bonds jumping 10 points, the last such move to happen when Trump became president.

Yields on 10-year French and Belgian bonds returned above 0% for the first time in months. The German equivalent has jumped 10 points, though it remains in negative territory.

"Huge long gold positions have been accumulated for months by mostly ETFs." says Naufal Sanaullah, chief macro strategist at EIA All Weather Alpha Partners.

The Japanese yen, one of the asylums, has weakened beyond 109, with Asian bonds also giving way and Japan's 10-year bonds jumping the most in the last six years.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.