- Home

- >

- Fundamental Analysis

- >

- Are we going to make money from GBP during April

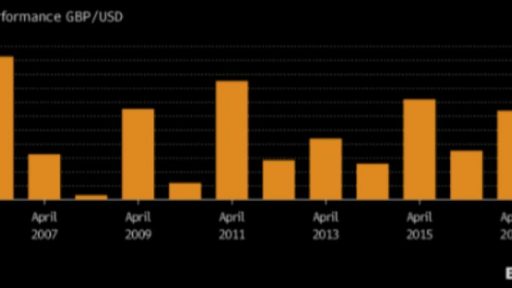

Are we going to make money from GBP during April

The pound’s good fortune is set to continue this month, if seasonality is any guide. Sterling appreciated versus the dollar every April during the last 13 years in what Bank of America Merrill Lynch describes as the strongest seasonal trend among Group-of-10 currencies. In a research note, the bank recommended a two-month option trade to take advantage of the periodic strengthening pattern.

The trend corresponds to a typical increase in incoming capital at this time of the year, driven by dividend payments to British shareholders from foreign companies and other investment inflows that mark the start of the U.K. financial year. The fact that sterling has strengthened in April even during past episodes of heightened financial instability and political risks helps boost conviction in the seasonality, according to Bank of America.

The pound’s 3.2 percent rally last April was the second-best monthly gain of 2017. While it is the third-best G-10 performer this year with a 4 percent gain to about $1.4050, option volatility on the currency averaged higher last quarter amid uncertainties about Brexit. Still, the seasonal appreciation pattern may withstand such concerns, according to Bank of America’s head of G-10 currency strategy.

Yet, seasonality won’t necessarily give sterling a large boost this year, given it has already rallied more than 2 percent in March, according to Rabobank. The bank sees the U.K. currency rising to $1.44 by the first quarter of 2019.

Source: Bloomberg Pro Terminal

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.