- Home

- >

- Daily Accents

- >

- Are we seeing short squeeze in the US bond market

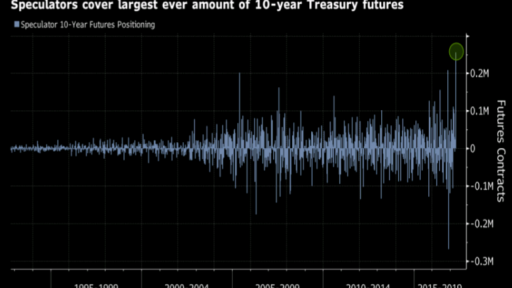

Are we seeing short squeeze in the US bond market

For the first time since July, hedge funds and other large speculators are bullish on Treasuries . While almost no one expects the Federal Reserve to raise interest rates Wednesday, traders are betting that officials will reiterate a plan to hike twice more this year and potentially deliver further signals on their intention to trim the central bank’s balance sheet.

Their change of heart came at a risky time. Althout no one expects FED to raise rate at this meeting, traders are still expecting 2 rate hikes until the end of the year. Anorher issue is the increasing geopolitical tension which may cause reat preassure over the stock market. Even though the winner of the french election is almost cetrain, we still must see the final results, and who knows... there might be as surprise. The investors prefer to move their capitals toward the safest market.. the bond market.

To be fair, hedge funds aren’t suddenly all-in on a bond rally, and their long positions aren’t nearly as large as their bearish wager to start 2017.

The benchmark 10-year yield has rebounded from its 2017 low of 2.16 percent on April 18. It was at 2.33 percent as of 6:37 a.m. New York time, climbing after Treasury Secretary Steven Mnuchin said Monday that ultra-long bond issuance could “absolutely” make sense.

“Given the likelihood that the economy rebounds in the second quarter, plus new risks coming out of Washington, it is a little dangerous to take an aggressive stance in the bond market,” said Gary Pollack, head of fixed-income trading at Deutsche Bank AG’s Private Wealth Management unit in New York.

Източник: Bloomberg

Trader Bozhidar Arabadzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.