- Home

- >

- Market Rumours

- >

- Ariel Investment is expanding its shares in MSG Networks

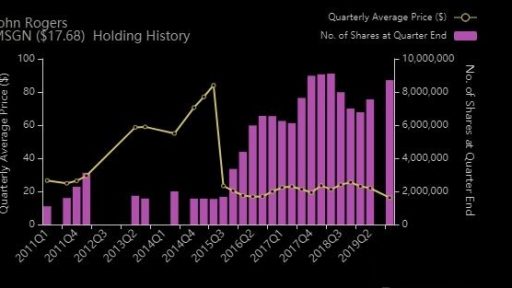

Ariel Investment is expanding its shares in MSG Networks

John Rogers, CEO of Ariel Investment, revealed that it has increased its stake in MSG Networks to 15.35%.

The Chicago-based guru firm invests in undervalued small and mid-caps companies that have sustainable competitive advantages. High barriers to entry and a predictable foundation. Rogers emphasizes patience, independent thinking and long-term vision. For him, these aspects are key in generating good returns.

The company has acquired an additional 1.6 million shares from a New York-based media company. The event happened on 31.10. Ariel already owns a stake of 8.7 million shares, representing 1.7% of their portfolio.

MSG Networks owns and broadcasts local sports channels, with a market cap of $ 1.6 billion. Analysts say the stock is currently trading at $ 17.37 undervalued. Traders expect stock to rise to $ 36.15.

Ariel's total portfolio is $ 7.96 billion, consisting of 153 positions. The major investments are in the financial sector, the cyclical consumer sector, the technology and industrial sectors.

Other media companies with which Ariel diversifies are The Interpublic Group Of Companies, CBC, Viacom, Omnicom, Meredith, Tegna and Madison Square Garden.

The fund's return for 2018 was -13.67%, with a lower performance than the S & P500, which was -4.38% then.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.