- Home

- >

- Fundamental Analysis

- >

- As for global growth, look at the metals, not the government bonds

As for global growth, look at the metals, not the government bonds

Australia's surprisingly strong GDP print may underpin the sort of global growth optimism that had Kyoungwha Kim forecasting gains in metals prices, but she put the cart before the horse in saying that raw materials should climb because 10-year U.S. yields are rebounding. For one thing, the signals from Treasuries are distorted by global QE and increased issuance. For another, the bond market is actually raising doubts about U.S. growth and inflation when you look at the narrowing yield curve and breakeven rates that have dropped well under reported CPI.

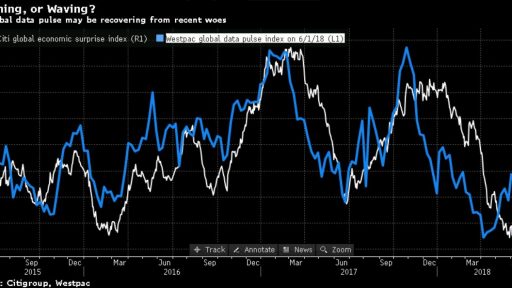

Global growth is stumbling as the Fed maintains its tightening policy. The rally in metals provides a flash of optimism, and the data pulse may be starting to claw its way back from the recent trough. If it does then, Treasury yields may break above 3% again -- but that will be a lagging indicator.

Citigroup's surprise index shows that global data releases are coming in at the weakest in four years relative to economist estimates. Westpac's global data pulse shows 44% of releases are coming in stronger than the previous outcomes, after just 38% did so in early April, the lowest since 2012.

Source: Bloomberg Pro Terminal

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.