- Home

- >

- Stocks Daily Forecasts

- >

- As Recession Fears Swell, Traders Lack Guts to Short Germany

As Recession Fears Swell, Traders Lack Guts to Short Germany

Fast-money traders do not seem to have the stomach to bet on interest rates in the heart of Europe.

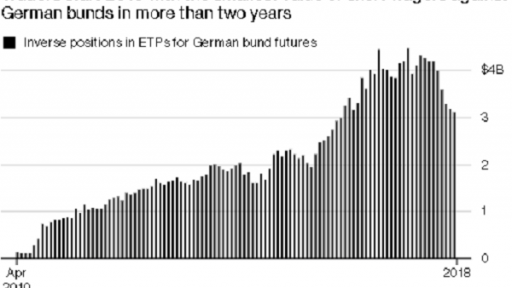

They entered in 2019 with the smallest equivalent of short stakes against German bundles for more than 2 years.

Investor positions - bets that will be paid if the debt falls in the region - fell for the fifth consecutive month to $ 3.1 billion at the end of December, according to data from WisdomTree Investments Inc. Data is 30% lower than January 2018.

"Investors are withdrawing from ETFs that offer short exposures to US and German debt," said Rafi Aviav, head of product development at WisdomTree in London. "This is a clear sign of an elevated sword attitude."

Decline in European yields and shares in January has had a negative impact on the economic performance that shows the continued softness in the region, such as the recent fall in French and German industrial output.

Delaying growth may keep yields on European bonds undermined, which will counterbalance ECB attempts to end the QE program.

"The ECB may put an end to the quantitative easing program but there are serious doubts about their willingness to raise interest rates," said Craig Erlam, senior market analyst, in 2019. "This keeps bucks expensive and yields low."

Passive products are just a fraction of the volume of the bucket futures market, where investors take speculative positions. But the numbers for short positions are very important because they show a market that is poorly protected by the securities industry.

The Commodity Futures Trading Commission does not publish short positions on European debt, as shown by the USSR and the euro.

Source: Bloomberg Finance L.P.

Original Post: As Recession Fears Swell, Traders Lack Guts to Short Germany

Chart: Used with permission from Bloomberg Finance L.P.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.