- Home

- >

- Daily Accents

- >

- As the U.S. heads for full employment, risk is rising for stocks.

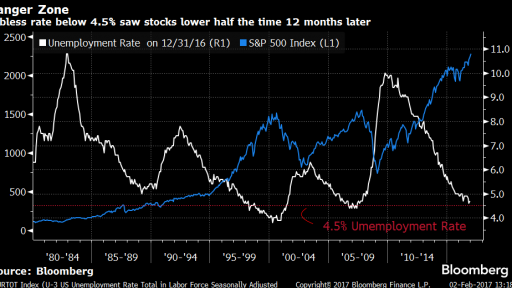

As the U.S. heads for full employment, risk is rising for stocks.

The unemployment rate has fallen close to levels that most Federal Reserve policy makers view as full

employment. That hasn’t boded well for future stock returns.

Four of the last five peaks in the S&P 500 came after the rate fell to between 50 and 100 basis points below full employment levels, according to Credit Suisse Group AG. And once it dipped below 4.5 percent stocks saw negative returns.

Perhaps the biggest potential challenge for U.S. equities in 2017 is the prospect of the U.S. labor market reaching, or exceeding, full capacity.

Stagnant wage growth and low interest rates have helped S&P 500 companies more than double their profits propelling stocks to record highs.

Complicating the employment picture is President Donald Trump’s promise to boost public spending. According to Morgan Stanley, it’s rare to see government pursue aggressive spending plans at a time when so many people are working. Such a combination only occurred twice, in the 1960s and 1980s. In 1968, the S&P 500 ended a two-year bull market in November and lost more than a third of its value during the next 18 months. In the other instance when Ronald Reagan’s fiscal stimulus in 1983 helped the economy recover from “double dip” recessions, the bull market in stocks lasted through 1987.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.