- Home

- >

- FX Daily Forecasts

- >

- Asia FX markets analysis

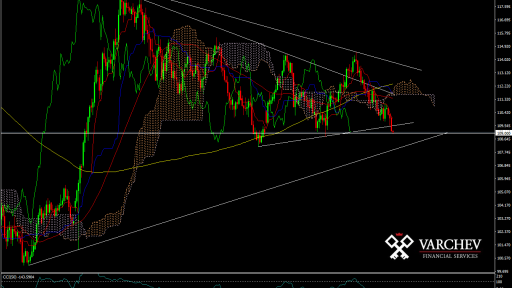

Asia FX markets analysis

USD/JPY fell more than 0.8% to a 109.16 low as JPY gained against all of its G- 10 peers; spot is seen gathering support at 109.00, where $1.6b of options expire Friday; breach of that level would likely trigger stops below 108.83.

JPY is guided higher by rising vols, as geopolitical risks stay in forefront; 1-month JPY vols are trading over 9% and 25-delta risk reversals are 1.425 in favor of JPY calls, lowest level in more than two months.

Crosses have fallen throughout the week, with a few, like NZD/JPY and GBP/JPY, reaching key support levels. Downside risks may be limited as Japan enjoys Mountain Day holiday; further selling possible if Friday’s U.S. CPI misses estimates.

AUD/USD was a spectator watching fireworks in other markets; spot rallied to 0.7902 New York session high after softer-than-expected U.S PPI then held to a tight range AUD/JPY, by contrast, was under pressure throughout the day, with prices falling ~0.95% to the lowest since July 7.

Gold rises to $1288/oz, highest level since June 8.

NZD/USD traded a narrow 0.7263/0.7293 range in light volumes, with prices ending the New York session at the top end of the spectrum. Kiwi’s more than 1% drop to its 0.7252 low was the largest one-day fall since May 11; 0.7200 is seen as congestive support.

NZD/JPY 3% plunge over the course of four days is its largest since November 2016; the 100-DMA at 79.502 provides near-term support.

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.