- Home

- >

- Daily Accents

- >

- Asian markets are expected to reflect negativism from the US and trade with a decline

Asian markets are expected to reflect negativism from the US and trade with a decline

Asian stocks look set to extend declines emanating from a slide in U.S. equities and gains for Treasuries and gold. Crude halted its rebound.

Equity-index futures retreated in Japan, Australia and Hong Kong. American retailers remained under pressure as disappointing results from Macy’s Inc. and Kohl’s Corp. added to concerns that the U.S. consumer continues to hold back on spending. Oil rose past $48 a barrel and the 10-year Treasury

yield slipped below 2.40 percent.

Global equities are trading near a record high amid optimism the economy can weather higher U.S. interest rates. Weak sales at American department stores underscored rising angst that the biggest part of the U.S. economy isn’t picking up the pace enough to raise growth rates. Investors will get a

fresh read on Friday with U.S. retail sales.

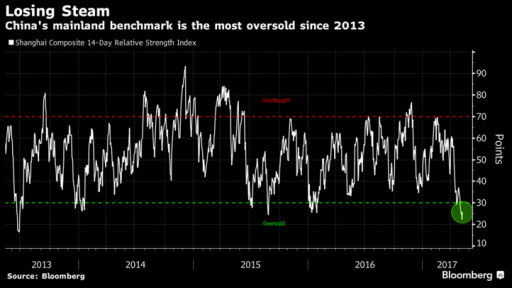

Money managers are still shaking off a rout that’s erased more than $560 billion from the value of Chinese equities, making them the world’s worst performers since mid-April.

China’s government has made preparations to support the Hong Kong stock market if needed to create a positive atmosphere before July 1, when Xi Jinping is expected to visit the city for the first time as president to mark 20 years of Chinese rule.

Here are the main moves in markets:

- The yen traded at 113.82 per dollar as of 7 a.m. in Tokyo.

- Futures on the Nikkei 225 fell 0.5 percent in Chicago trading, while contracts on Australia’s S&P/ASX 200 Index retreated 0.2 percent. Futures on Hong Kong’s Hang Seng Index fell 0.5 percent.

- S&P 500 e-mini contracts were flat after the underlying gauge slid 0.2 percent Thursday. The Stoxx Europe 600 fell 0.6 percent, after gaining 0.2 percent Wednesday to the highest level since August 2015.

- The yield on 10-year Treasury notes fell three basis points to 2.39 percent after rising for the past three sessions.

- Oil slid 0.1 percent in early Friday trading. Crude climbed for a second day Thursday, leaving the worst of last week’s rout behind for now, as U.S. stockpiles fell and two OPEC members said there’s a consensus to extend output cuts.

- Gold traded flat at $1,225.41 after a 0.5 percent advance Thursday.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.