- Home

- >

- FX Daily Forecasts

- >

- AUD/CAD – Opportunity for Short with Trend

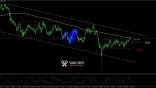

AUD/CAD - Opportunity for Short with Trend

AUD/CAD - D1

Our expectations - The price is in a downward trend following a correction that provides good levels for building a medium-term short position. The price is in a resistance zone formed by a horizontal horizon and 23.6% Fibonacci correction. In addition, the strong Price Action over the previous two days clearly shows that bears still dictate the rules. We have a bearish swallow bar on daily chart - a strong signal to support the short. RSI rebound from level 50 - the downward trend is retained. Upon closing the swallow bar, Sequential counts the 1st signal to start a new descending impulse. After the start of the new day, we have a pair available - the impulse is in effect. Positioning from the current levels will be risky and will lower the RR factor, so we need to wait for a slight upward correction and re-entry into the resistance zone (the blue area of the chart). Entering a deal in this way will maximize the RR factor and maximize SL.

SL: 0.96753 Far from the previous peak and the main diagonal to avoid Stop Hunting.

Alternative Scenario: If the price goes above the resistance zone and stays there in several consecutive bars, the negative scenario will be spoiled and we are more likely to see an increase in the pair's course.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.