- Home

- >

- FX Daily Forecasts

- >

- AUD/JPY – Opportunity for Short term short trade

AUD/JPY - Opportunity for Short term short trade

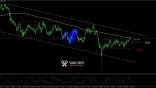

AUD/JPY - H4

Our expectations: The price is in a long and short-term downward trend, and the current retracement to key levels, gives a good opportunity to sell the pair. Looking at the daily chart, it is clear that the price is testing the breakthrough in the broad consolidation we observed between the end of March and the beginning of August this year.

The current positive momentum comes at a time of strong growth in US and European indices, which weakens JPY. Why should we look for Short trades at this time? Asia remains under pressure amid the tariffs the US and China exchange, and the current JPY correction will give Asian traders a very good opportunity to buy yen cheaply to hedge their long positions in the stock.

How to position yourself?

On the main graph (H4), we can trace the formation of the resistance zone. There is an area of horizontal resistance coupled with a basic descending diagonal. In support of the short idea are 50% Fibonacci correction of short-term Downtrend and 200SMA. DeMarker is in an oversupply zone but still does not report a drop. Sequential counts 7 out of 13 possible top - we'll probably see short-term consolidation before the start of the bearish impulse.

Entry options are two, risky and conservative. Entry from the current levels would be risky, and a further upward adjustment would be ideal for positioning more conservative traders.

SL: 81.225 to avoid Stop Hunting.

Alternative Scenario: If the price moves and stays above the baseline, the negative scenario will be spoiled, and we are more likely to see a rise in the pair's price.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.