- Home

- >

- FX Daily Forecasts

- >

- AUD/USD – Opportunities for short positions with a good risk/reward ratio

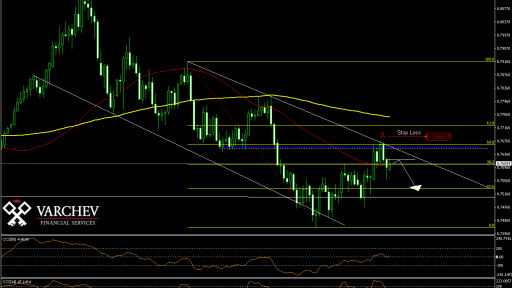

AUD/USD - Opportunities for short positions with a good risk/reward ratio

AUD/USD Daily Chart Our Expectations: Declining mid-term trend, correction to structural horizontal and diagonal support. Opportunity for short positions with SL 0.7689.

Alternative scenario: If the price goes above the two resistances, there could be a test of the 200 SMA. Around these levels there will also be a breakaway of 61.8% Fibo of the declining movement - which means, that the short trend is over and a new long is beginning. In that case, we wait for a breakaway and test of 200 SMA and go long after a confirmation from a price action signal.

Commentary: Declining mid-term trend, correction to structural horizontal and diagonal resistances. 50% Fibo held to the test, and there was a inside bearish bar and a breakaway of the low of the bar. At the moment there is a correction, which will allows us the better price for entry and a shorter stop. 50/200 SMA in bearish formation. For a more precise entry, we wait CCI 50 to goes below 0 and entry when CCI 14 crosses in negative territory.

Fundamental: USD is supported by the growing expectations of a more aggressive Fed and more protective Trump. At the G7 Summit, Trump's stance regarding Canada benefited the greenback at the expense of the CAD and tomorrow traders are awaiting the CPI data - which is a key measurement tool for the inflation. In Wednesday market participants anticipate the Fed's Interest Rate decision, as traders price in the probabilities for a hike at 84% - in other words - a very safe bet. Regardless that more of that anticipation is already priced in USD charts, I expect the news to support the greenback further. Fed will hike the rates one more time till the rest of the year /except on Wednesday/, which will additionally support the dollar.

On a weekly chart there's a breakaway of the diagonal trendline and now the price is making a test of the breakaway. This additionally supports the case for a strong USD and a weak AUD.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.