- Home

- >

- FX Daily Forecasts

- >

- AUD/USD with a good opportunity for a new position at the beginning of the week

AUD/USD with a good opportunity for a new position at the beginning of the week

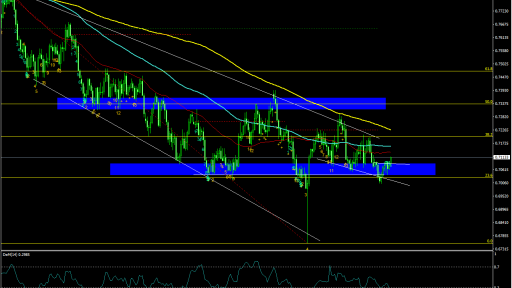

And this is a good sign for the buyers, after last week's breakthrough attempts over 0.7100 were unsuccessful. There is little resistance above 0.7120-25, but a breakthrough over it can raise the price to 0.7160, where 100 MA is located.

If buyers can push the price up there, it will break the downward momentum and the price may potentially begin to rise back to 0.7200 over the next few sessions. Although yield is still a long-term game for the pair, the fact that the bulls have shown resistance in the defense of 0.7000 means that the risk-reward ratio is still not perfect.

The difference in yields of 10-year US and Australian bonds is shrinking, and this is also a contributing factor to the AUD / USD rise, along with a weak dollar and a sentiment of positive risk early this week.

For the upcoming session there are no key economic news to determine the direction, so look at the technical levels for clues. As mentioned above, the resistance region around 0.7120-25 will dictate further delays on the upward path, while downside chances remain limited by the key creeping mean of the hourly chart.

For correct positioning, we wait for the day bar to close and enter the lon after at least 30% correction and stop below the subcatch around 0.7030.

For more aggressive traders, there is also a good scenario: We are waiting for a breakthrough test of the headline and shoulder and set the stop to the same level.

Alternative Scenario: Returning and closing the daily chart price back to the support area will break this bullish scenario, and then we have to wait for the confirmation of the direction and price action signal.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.