- Home

- >

- Fundamental Analysis

- >

- AUDJPY to increase with carry trade

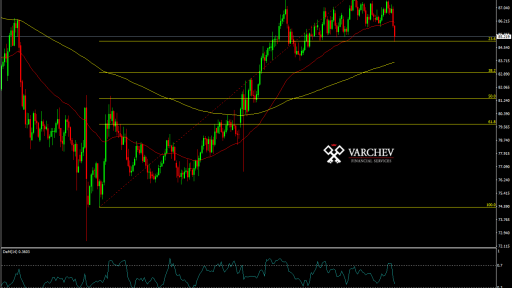

AUDJPY to increase with carry trade

The strategy "carry trade" is mired in the past few weeks. With higher interest rates in the US, trade with this strategy should move forward and become very profitable.

The US 10-year bonds have a 2.575% interest rate. This compares with 0.010% of Japanese government securities. The Bank has been pressuring the long end to keep interest rates as low as possible for as long as possible. However, the payoff has only been small in comparison to what is really needed to push economic growth forward for Japan.

At the same time, should you be long USDJPY in the FX market you are long the carry trade. You are borrowing the JPY to buy USD. The differential is paid out to the long, and higher side of the interest trade. In this case, since the USD is higher, you are paid the differential between a bank rate in America versus a bank rate in Japan. By carrying the trade overnight, past the New York fix, you are paid that differential (as opposed to being short the differential paying the other side).

Perhaps US interest rates will head higher and faster than any other market participants.

The increase in wages and consumption continue to push forward the economy and jobs open with healthy rate.

If Republicans actually get their tax break pushed through, then the economic activity in the United States will have the opportunity to increase even more. Right now, the tax structure favors American corporations leaving money overseas. Bring those funds into the United States with tax credits and banks will be in a position to lend these funds out and accelerate the economy even more.

Source: SeekingAlpha

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.