- Home

- >

- Fundamental Analysis

- >

- Australian dollar under pressure from growing debt in Australia

Australian dollar under pressure from growing debt in Australia

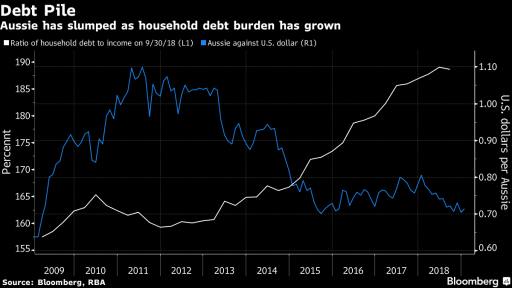

The besieged Australian dollar is facing a growing threat: addiction to real estate, creating a new mountain of debt.

Since in 2018 AUD was the worst performing currency than developed countries, the Australian is expected to continue with the losing streak this year as well. Households report an ever-increasing level of debt and, overall, the state of the economy is disturbing. These factors make the Central Australian Bank scenario more likely to reduce the base interest rate. HSBC saw the Australian drop 7% against the US dollar by the end of the year.

"RBA just stood by the side and watched the mortgage bubble widen in recent years." - says Michael Eevery, Head of the Asian Financial Markets Division at Rabobank in Hong Kong. "Now that the FED is already thinking about keeping the interest, it's time for the RBA to think about cutting the levels, and they will."

The debt-to-household ratio has skyrocketed to 189% from 67% in 1990. The gap has increased significantly in recent years, as the fall in interest rates has encouraged households to borrow more money, while loosening lending by banks has increased the available cash.

The Australian has already fallen over the last five quarters, including a 9.7% drop for the past year. This was due to the strained relations between the US and China around the trade war and fears of a slowdown in global economic growth, which hit Australia as an exporting country.

HSBC's swift attitude toward the currency has stemmed from debt leakage in the country, as well as the widening of the yield curve for Australian bonds compared to US dollars.

Rabobank believes the RBA will cut interest rates by about 100 basis points from a record low of 1.5%, with the idea of helping to cope with high levels of debt.

Morgan Stanley predicts a fall to 67 cents for the Australian in the second quarter, but then to recover 71 cents by the end of the year.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.