- Home

- >

- Fundamental Analysis

- >

- Automakers lead global stocks lower, while the Yen advances

Automakers lead global stocks lower, while the Yen advances

Global stocks slipped, taking their cue from a weaker U.S. equities session as automakers slumped on weaker- than-expected sales. The yen strengthened while the Australian dollar dropped.

Automakers from Honda to BMW tumbled as monthly sales offered a warning that Americans may have become more thrifty.

The Aussie dropped and government bonds climbed after that nation’s central bank left rates unchanged. South Africa’s rand extended declines for a seventh day after the country lost its investment-grade credit rating from S&P Global Ratings for the first time in 17 years. The Russian ruble dropped after a subway bombing in St. Petersburg.

Investors are taking stock ahead of a key U.S. payrolls report on Friday and minutes from the Federal Reserve’s latest meeting on Wednesday. Global equities last week completed the best quarter since 2013 as the reflation trade triggered by Donald Trump’s U.S. election victory shows resilience and stronger global growth underpinned gains. Nonetheless, risks remain, from prospects over implementation of the president’s pro-growth agenda and the path of higher U.S. interest rates.

Veteran money manager Bob Doll at Nuveen Asset Management LLC is becoming increasingly worried that the American economy poses a greater threat to the U.S. stock rally than the political tensions traders are currently focused on. Sentiment on the economy may be too high, leaving investors vulnerable to negative surprises on growth, he said.

The yen rose 0.3 percent to 110.53 per dollar, after climbing 0.5 percent in each of the previous two sessions. The Bloomberg Dollar Spot Index added 0.2 percent.

The Aussie dollar fell 0.5 percent, bringing its four-day decline to 1.3 percent. Australia kept interest rates unchanged, remaining in a form of policy paralysis as housing is too hot to allow an easing and the economy too weak to absorb a tightening.

The Russian ruble dropped 0.5 percent after the bombing in St. Petersburg killed 11 people and injured dozens more. The South African rand dropped 1.3 percent. The currency has tumbled 12 percent over the past seven days amid a cabinet purge by President Jacob Zuma that’s sparked increasing calls for him to resign. The euro fell 0.2 percent and the British pound was 0.4 percent weaker.

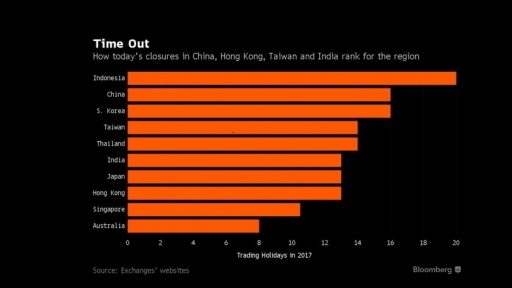

The Topix index lost 0.8 percent, with Honda Motor Co., Mazda Motor Corp. and Nissan Motor Co. dropping more than 2.5 percent. The Australia’s S&P/ASX 200 Index slid 0.3 percent. China, Hong Kong, Taiwan and India were closed for a holiday. The Stoxx Europe 600 index rose less than 0.1 percent, as gains in energy shares offset declines in auto stocks. The Philippines benchmark index jumped 1.4 percent to the highest level since October, while Indonesian shares rallied 0.7 percent to extend a record. Futures on the S&P 500 lost 0.3 percent. The underlying gauge slid 0.2 percent on Monday.

Oil slipped 0.3 percent to $50.07 per barrel, after dropping 0.7 percent on Monday as a rally above $50 runs out of steam. Gold rose 0.3 percent to $1,256.59, advancing for a third day amid speculation the Fed may go slower on rate hikes after the worse-than-expected U.S. auto sales for March.

Bloomberg

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.