- Home

- >

- Daily Accents

- >

- Bad news is good news for Wall Street again

Bad news is good news for Wall Street again

In the years after the financial crisis, a certain financial mantra became popular - bad news is good news, and this mantra has returned. This should remind investors that positioning themselves on the wrong side of a central bank may be quite dangerous.

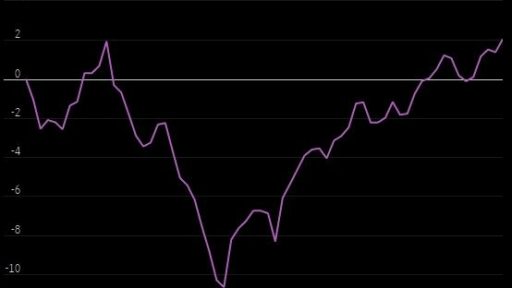

The MSCI All Country World Index has covered all of its losses in the "panic" of 2018. It is the worries that interest rates will rise steadily in parallel with the risks to global growth sparking the sudden sell-off.

The recovery of global stocks occurs despite disappointing economic data, mostly from China, Germany, and even the United States. This "crack", along with the deterioration in corporate reports, proved to be a rather lethal combination. The change in sentiment from the beginning of the year left no broad index without promotions except India. Each sector in the S & P500 reflects an increase, the economic growth and the value of the shares began to increase.

The optimistic approach of the markets began to remind of the times when Ben Bernanke headed the Federal Reserve. When the Central Bank bought bonds in a stable amount and the interest rates were almost zero. Then the bad economic data and news often triggered a strong rally in US stocks, because investors were betting the economy that in this state would slow down monetary tightening plans.

The same counterintuitive dynamics is present now. The Fed kicked off the current rally when it first signaled that maybe they would stop raising interest rates for the moment. Any subsequent negative information and weak data only serve to raise the hopes that the FED would even become even more dovish. In addition, the assumption is that other central banks around the world - mostly in Asia - will feel the tension of policy tightening weaker.

But investors can not fight the Fed. However, the power that the Central Bank shows must also attract attention to investors. If the Fed thinks that investors have interpreted their overly cautious position, any further explanation or slight hint of diversion can cause a strong sellout - as strong as the current rally.

Source: The Wall Street Journal

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.