- Home

- >

- Market Rumours

- >

- BAML: Europe may be the eye of the storm in the next crisis

BAML: Europe may be the eye of the storm in the next crisis

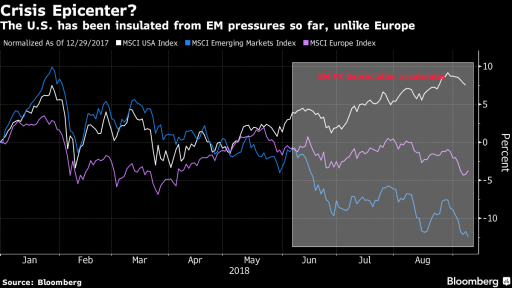

If the current worsening of emerging markets deepens and grows into a global economic crisis, Europe may be the eye of the storm! - Warned by Bank of America Merrill Lynch.

The collapse of the emerging markets currencies as well as the strength that the USD shows had a negative impact on European equities, with their overall performance far worse than the US companies. With its policy of open economy and relatively high levels of external debt, the region is highly vulnerable and dependent on the problems of developing economies and, above all, Turkey.

Tommy Ricketts, a strategist at BAML in Europe, could repeat what happened to Japan on the eve of the Asian financial crisis in the late 1990s.

"If the crisis with emerging markets grows globally and covers more asset classes, we think stress will come from Europe as it came from Japan in 1998," Ricketts said.

According to Ricketts, the risk is that volatility in emerging markets will trigger an expansion of European corporate credit spreads currently artificially suppressed by the ECB's QE, which will also affect US credit markets and stocks.

Another risk lies in the appreciation of the euro as European investors will turn their currencies from emerging markets and expect a stricter monetary policy for the ECB. This in turn will put pressure on the profits of companies in the region.

The European Central Bank is expected to confirm that it plans to delay the October bond purchase program before raising its interest rates by the end of 2019.

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.