- Home

- >

- Fundamental Analysis

- >

- Bank of America: bull market as we know it is dead. Here is how to protect yourself

Bank of America: bull market as we know it is dead. Here is how to protect yourself

BANK OF AMERICA: The one-of-a-kind bull market is basically dead — here's what traders can do to protect themselves from the coming collapse

Bank of America Merrill Lynch argues the equity bull market as we know it is over, and urges investors to start looking ahead at how to combat the coming collapse.

It offers a "perverse" trade suggestion to help combat the economic recession that's likely to accompany any stock-market crash.

At this point, everyone knows that the ongoing equity bull market is the longest on record.

But there's another attribute that makes the 9-1/2-year bull run truly unique compared to history: its deflationary nature.

If you're unfamiliar with the concept of deflation, it refers to the general decline in prices for goods and services. As it relates to the market, Bank of America Merrill Lynch points out that as stocks have soared to record highs, brokerage commissions have slipped from $80 billion to $30 billion since 2000.

"It's been the most deflationary bull market of all time," Michael Hartnett, BAML's chief investment strategist, wrote in a recent client note.

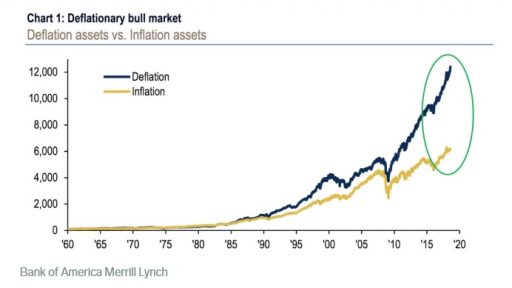

This dynamic can be seen in the chart below, which shows the extreme degree to which deflationary assets have outperformed their inflationary counterparts over the past decade or so.

For context, the deflation group includes government bonds, US investment-grade bonds, the S&P 500, US consumer discretionary equities, growth stocks, and US high-yield credit.

Meanwhile, the inflation group contains commodities, Treasury inflation protected securities (TIPS), developed market stocks (ex-US and Canada), US banks, value stocks, and cash.

Bank of America Merrill Lynch

But why? How did the longest bull market on record end up carrying such an unflattering distinction?

BAML attributes it to what it calls the three Ds: technological D isruption, aging D emographics, and excess D ebt.

To make matters even more dire, BAML argues the bull market as we know it is essentially over. As Hartnett puts it, "end of excess liquidity = end of excess returns." And since monetary tightening from global central banks is widely expected to drain liquidity, returns won't be far behind.

Harnett also highlights the fact that if you remove US tech from the equation, global stocks are actually down 7% this year. That's hardly the sign of a thriving bull market.

In the likely case that the inevitable crash in global asset prices also ushers in a full-blown economic recession — as it frequently has in the past — BAML offers what it calls a "perverse" trading suggestion.

It says traders should buy the inflationary assets that have been so righteously shunned during the bull market. That specifically means commodities, developed-market stocks outside of the US and Canada, bank stocks, and value equities.

With those recommendations in mind, you should be at least somewhat well-equipped to battle any coming recession. And even if you end up feeling pressure, following these types of trade suggestions should at least spare you the maximum level of pain.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.